What happened in May?

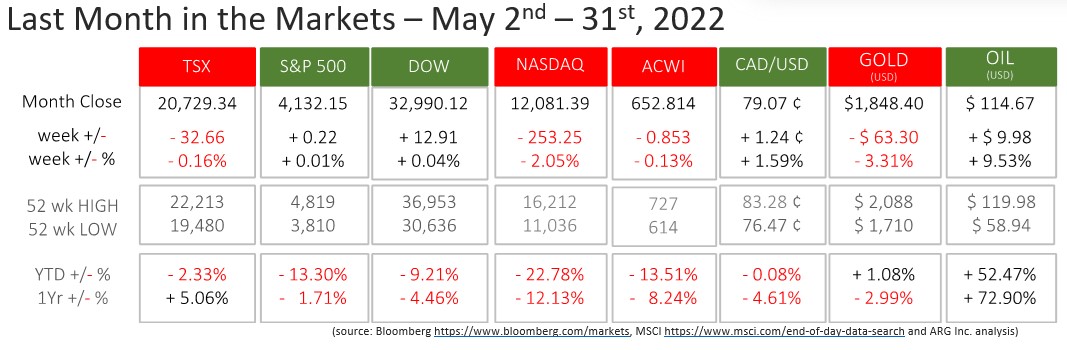

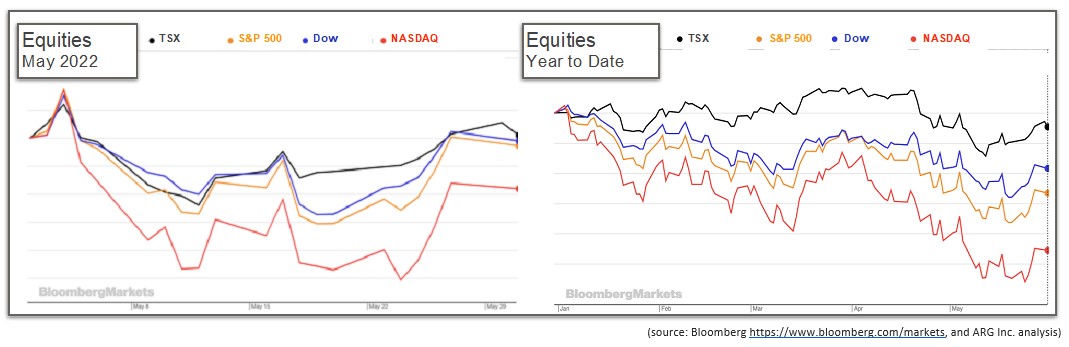

Despite significant volatility during May by the end of the month the major North American indices had settled almost where they had begun. The NASDAQ, more heavily weighted to technology, lost 2%, and the broad-based TSX and S&P 500, and the large corporates of the Dow, were flat for May.

The month really began on Wednesday, May 4th, when the U.S. Federal Reserve increased short term interest rates. The 50-basis point increase (+0.50%) to the federal funds rate was the largest increase since 2000. Immediately after the Fed’s announcement, equity markets reacted positively, but the gains achieved in on Wednesday were reversed the next day. The Dow rose 932 points before losing 1,063, the S&P 500 gained 125 points, then lost 154. The TSX gained 473 points on Tuesday and Wednesday before dropping 489 on Thursday. The NASDAQ gained 402 points on Wednesday before dropping 764 by week’s end. Fed Press

The Federal Reserve’s increasing of interest rates was further justified on May 6th when April’s non-farm payrolls showed that employment had increased by 428,000. With the unemployment rate (3.6%) and number of employed (5.9 million) holding steady, the Bureau of Labor Statistics indicated the similarity of these numbers to pre-pandemic data in February 2020. The labor force participation rate is 1.2 percentage points below the February 2020 level of 63.4%. https://www.bls.gov/news.release/empsit.nr0.htm

In Canada, the number of jobs remained unchanged in April, as did the employment rate (61.9%) and the unemployment rate edged downward by 0.1% to 5.2%. Average hourly wages rose at an annualized rate of 3.3%, also unchanged from March. StatsCan

The release of the U.S. Consumer Price Index (CPI) on May 11th was a significant contributor to equity volatility and losses during the second full week of last month. Thankfully, price increases during April were less than March, but the annual and monthly inflation rate remains at a historically high level. Inflation of 8.3% over the past year was led by shelter, food, airline fares and new vehicles in April. Ongoing inflation at this high-rate signals that the Federal Reserve will remain aggressive on monetary policy, especially for short-term interest rates. U.S. Bureau of Labor Statistics

Canada’s Consumer Price Index (CPI) rose in April slightly to 6.8% compared to March’s 6.7%. Food and shelter were two categories that drove the increase.

“With the unemployment rate falling to a record low in April, strong employment figures tend to put upward pressure on prices. In April, average hourly wages for employees rose 3.3% on a year-over-year basis, mean that, on average, prices rose faster than wages, and Canadians experienced a decline in purchasing power.” StatsCan link

Inflation was not limited to North America as China’s CPI and PPI (Producer Price Index) in April arrived above estimates at annualized rates of 2.1% and 8%, respectively. These prices were driven by increasing demand due to panic buying as another pandemic wave hits, continuing supply chain issues, and rising commodity prices driven by the invasion of Ukraine. China CPI PPI

The supply chain and commodity price issues affecting China are global, and until they are resolved, inflation will persist. Central banks will seek to temper inflation by increasing interest rates. The Federal Reserve has telegraphed ½% increases at its next two monetary policy meetings on June 15th and July 27th.

The economic news in the popular press was not much improved during the last full week of May, but equity results were. Upon close examination some detail provided some glimmer for equity investors. The price of gasoline, which is a bellwether for many consumers, continues to rise this month, but the overall inflation rate is moderating. Prices continue to climb, but at a lower rate in the U.S. Inflation is at a 30-year high, and central banks, like the Federal Reserve, have indicated that their strongest action will be early 2022. CPI source FOMC Minutes

What’s ahead for June and beyond?

On June 1st, the Bank of Canada increased short-term interest rates by the same 50 basis points that was incurred in April. The effects of higher interest rates in Canada and in the U.S. will begin to be felt in the coming months. The goal is to temper economic growth while maximizing employment without falling into recession or stagflation. The indications from the Bank of Canada and the Federal Reserve are that interest rate increases will begin to lessen as the year proceeds. The fear of recession at the central bank level is producing some positive influence to equity markets. WSJ Article