What happened in March?

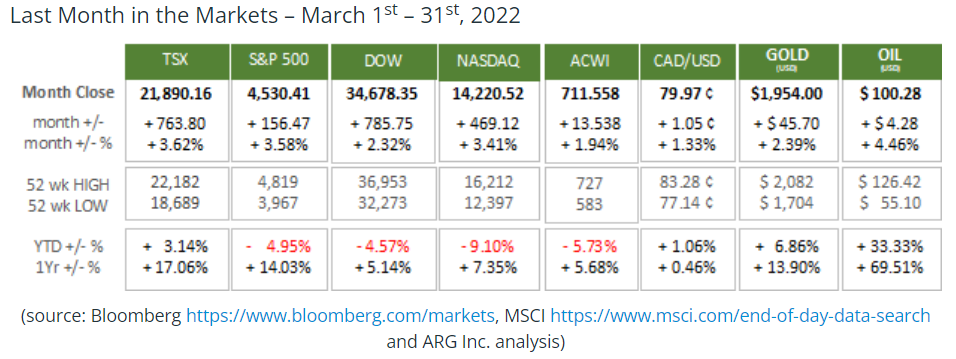

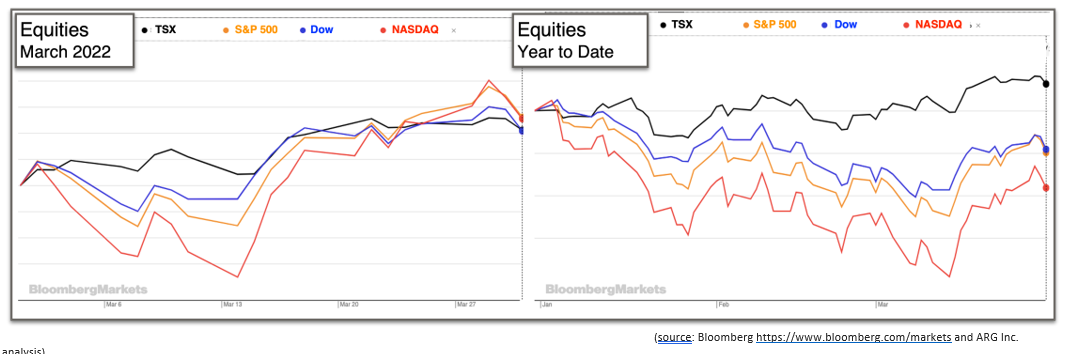

For the fourth consecutive month North American equities dipped mid-month and then recovered before month’s end. The TSX continued its recent, strong performance gaining nearly 4% for the month and more than 17% for the past year. The American indices performed well last month but are still in negative territory for this year. All indexes follow the same pattern in the Year-to-Date graph below, but at differing levels of performance.

The Bank of Canada (BoC) raised interest rates by ¼% on March 2nd to combat increasing inflation. Interest rates in Canada had not increased since 2018. The BoC stated, “The unprovoked invasion of Ukraine by Russia is a major new source of uncertainty. Prices for oil and other commodities have risen sharply. This will add to inflation around the world. . . “ BoC

Employment in February rose by 678,000 and unemployment fell slightly to 3.8% according to the U.S. Bureau of Labor Statistics. As of the end of February 6.3 million people remained unemployed compared with 5.7 million unemployed persons and an unemployment rate of 3.5% two years prior in February 2020.

One of the major contributing factors to the shortfall in current employment is the Labour Force Participation Rate. About 2 million less Americans are seeking jobs today than two years ago. It appears that a leading reason to stay out of the labor force is the perception that unsafe working conditions persist without pandemic safety measures and conscientious enforcement. BLS.gov Release

It seemed the good news had ended by the time the International Monetary Fund commented that commodity prices surged dramatically adding more inflationary prices to existing price increases caused by supply chain disruptions and emergence from the Covid-19 pandemic. “Price shocks will have an impact worldwide . . . “ IMF Statement

The U.S. Consumer Price Index (CPI) rose 0.8% in February and 7.9% over the past 12 months (before seasonal adjustment), and before the economic effects from Ukraine had begun. The two most significant contributors to the highest rate of American inflation in the past 40 years were Food (7.9%) and Energy (25.6%). Excluding Food and Energy, the All-Items index, prices rose 6.4%, which is the largest 12 month change for this category of goods and services since August 1982. BLS CPI

Canada’s CPI for February rose 0.6% moving the annualized inflation rate to 5.7%, the highest it has been since August 1991 when it was 6.0%. Food, housing, and gasoline were major contributors. Gasoline, for example, has risen 32% since February 2021. Thankfully, Canadian inflation is below the 7.9% U.S. rate, but well above the target range set by the BoC, which drove their action to raise interest rates. StatsCan

In response to U.S. inflation sitting just under 8%, the Federal Reserve increased the federal funds rate by ¼% to a range of ¼% to ½% in the middle of March. The Fed “anticipates that ongoing increases in the target range will be appropriate.” At the time of the announcement as many as six rate increases are expected from the Fed in 2022. Federal Reserve Announcement

The European Central Bank met in Frankfurt and announced their latest policy to address Continental consumer inflation and the crisis in Ukraine. Bond buying will end this summer, which will then allow for interest rate increases to trim inflation. ECB Statement

After the mid-month trough, equities performed exceptionally well as the TSX set a new all-time high and U.S. indices made major gains even as hopes for a ceasefire in Ukraine wavered, inflation continued, and interest rates rose. The uptick in March follows a prolonged downturn, where the S&P 500, Dow, and NASDAQ produced negative Year-to-Date performance. Institutional investors drove gains in the third and fourth week of the month as fewer sellers were outnumbered by buyers. Buyers vs Sellers

On the last day of the month the Gross Domestic Product figures for February were released by StatsCan. GDP rose by 0.8% in February up from 0.2% in January. Projections for Q1 GDP growth have increased to 4%, as have expectations for larger interest rate increases from the Bank of Canada. February GDPWhat’s ahead for April and beyond?

On April 7th at 4 pm Eastern time, the governing Liberals will deliver their next budget. Several extensions and additions are anticipated, including $10/ day childcare, a national dental care program and steps toward a national pharma care program, and emissions reduction. Based on geopolitical turmoil defense spending is likely to rise from its current level of 1.4% of GDP toward the NATO goal of 2%. Federal Budget

The next opportunity for the Bank of Canada and the Federal Reserve to increase interest rates to temper inflation occurs on April 13th and May 4th. After March’s price increase to oil caused by the invasion of Ukraine and its disruption of energy supplies is embedded in the overall inflation rate, larger and more frequent interest rate increases by central banks seem a certainty. Interest Rates