What happened in September?

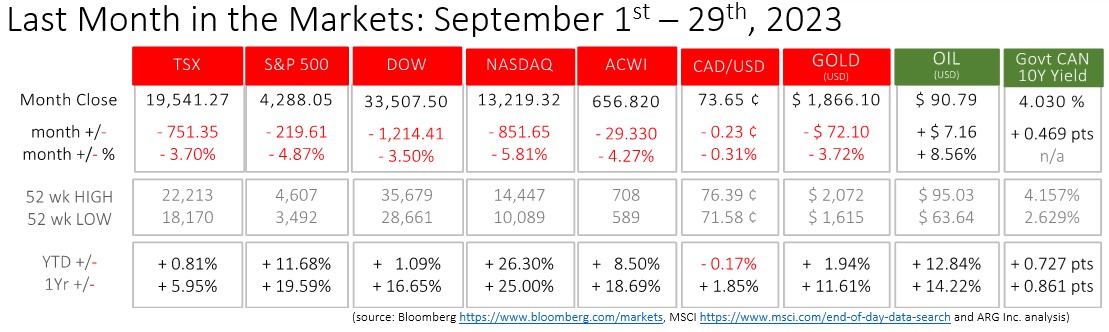

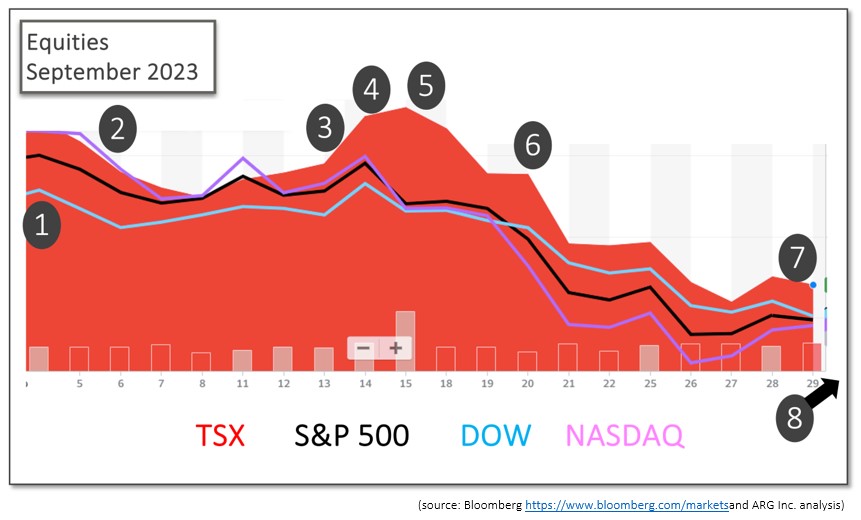

It was a difficult month for most investors as equities, the Canadian dollar and gold all lost value. The rising price of oil may have reduced the losses for the TSX, but on a broad-based basis a loss of more than 3½% for the month did not deliver the desired results.

August had, essentially, five weeks of trading last month, but September a shorter month with a holiday in both Canada and the U.S. and the timing of weekends seemed significantly shorter. However, the return to business following the end of summer produced several developments for investors.

September 1st

The month began with the release of the U.S. employment report that showed 187,000 nonfarm payroll jobs had been added in August, and the unemployment rate rose to 3.8%. Employment trended upward in health care, leisure and hospitality, social assistance, and construction, and declined in transportation and warehousing. BLS release

September 6th

At its latest interest rate decision, “The bank of Canada (today) held its target for the overnight rate at 5%, with the Bank Rate at 5 ¼% and the deposit rate at 5%. The Bank is also continuing its policy of quantitative tightening.” Considerations included the moderating of inflation in advanced economies, while remaining above goal, slowing global growth, led by China, and robust consumer spending in the U.S. Bank of Canada announcement

September 13th

U.S. CPI rose 0.6% in August, after rising only 0.2% in July. “Over the last 12 months, the all-items index increased 3.7 percent before seasonal adjustment” according to the Bureau of Labor Statistics. Core inflation, which excludes food and energy, rose more than expected at 0.3% for the month. CNBC and August inflation BLS release CNN and August inflation

September 14th

The European Central Bank (ECB) increased its three key lending rates by 25 basis points. North American AND European equity indexes jumped-up on the news, and the Europeans leapt higher on a percentage basis (screen shot) https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.mp230914~aab39f8c21.en.html

September 15th

The United Auto Workers (UAW) began a strike against the Big 3 U.S. car manufacturers for the first time walking out at all of them simultaneously. At the end of the month the UAW expanded its strike action further as the rhetoric from both sides continued. APNews and UAW strike

September 20th

At the latest monetary policy announcement from the Federal Reserve, Chair Powell stated, “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated.” Consequently, the federal funds rate was maintained at a range of 5¼ to 5½ percent. Federal Reserve announcement and press conference

September 29th

Released on Friday was the U.S. Federal Reserve’s primary inflation indicator, Personal Consumption and Expenditures Price Index. In August prices rose by 0.4% (down from 0.9% in June) in aggregate, excluding more volatile food and energy saw the index rise by 0.1%. This was the smallest monthly increase since November. The core PCE level is down from 4.3% in July and is at its lowest level in nearly two years. These levels were slightly below expectations, and the year-over-year annual increase for core PCE was 3.9%, which matched the forecasts.

The continuing improvements in the battle against inflation suggests that the Federal Reserve is nearing the end of its rate increases. BEA's PCE release CNBC and PCE

September 30th

The trading-week had ended before a deal was reached in the House of Representatives on Saturday evening. It is a stop-gap measure, that extends spending for an additional 45 days after it is expedited and approved in the Senate and signed by President Biden just prior to Sunday’s 12:01 am deadline. CNBC and "shutdown" CNN and "shutdown"

What’s ahead for October and beyond in 2023?

After avoiding a U.S. government shutdown, two important interest rate announcements from the Bank of Canada and Federal Reserve’s will occur on October 25th and November 1st, respectively. The threat of a U.S. government shutdown in mid-November may be repeated unless a full spending bill is passed.