source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis

What happened in August?

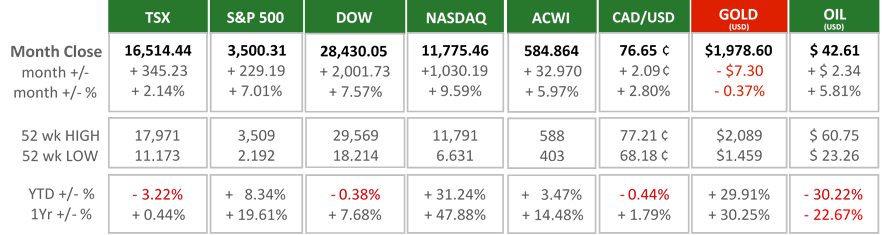

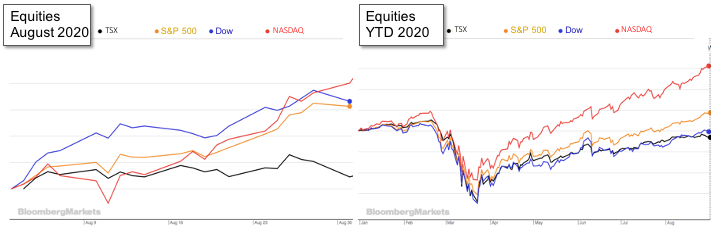

Equities continued their positive momentum during the month of August by achieving the fourth consecutive month that all four North American indices made gains. The NASDAQ and the S&P 500 have bested their February peaks, regaining all of their Covid-related losses. The Dow is within 3% of its February peak, while the TSX is 6½% below its value in mid-February.

The TSX is fulfilling its traditional moderate behaviour relative to the U.S. indices by rebounding more slowly and with less enthusiasm than its American peers. However, it should be noted that the Canadian dollar has been strengthening against the U.S dollar, especially in July and August. These foreign exchange gains indicate that Canadian investments are worth more against American investments than their Canadian-dollar prices indicate.

Globally the All Country World Index (ACWI) in our grid reached a 52-week high during August, which demonstrates that equity markets have surpassed the difficulties of the last six months.

(source: ARG analysis and Bloomberg https://www.bloomberg.com/markets)

The most recent positive influence for American equity markets was the announcement by the Federal Reserve that it will be suppressing interest rates by viewing employment levels and inflation differently. At its annual Jackson Hole Symposium, Jerome Powell announced that the Fed will now encourage greater levels of employment, which formerly served as a signal that inflation could occur. Previously, the threat of inflation based on high employment has caused the Fed to increase interest rates in the past. Additionally, Inflation will now be a calculated average (not a monthly figure), that will allow periods of inflation over 2% to be offset by periods below 2%. This policy change will cause interest rates to remain low for longer periods of time as higher levels of employment will be encouraged and inflation will be allowed to float over 2%. The Fed is emphasizing the need for employment and lessening its concern over high inflation during periods of economic growth.

https://www.nytimes.com/2020/08/27/business/economy/federal-reserve-inflation-jerome-powell.html

https://www.nytimes.com/reuters/2020/08/27/business/27reuters-usa-fed-jacksonhole-framework-explainer.html

What’s ahead for September and beyond?

The rhetoric and analysis of the economic effects of the upcoming U.S. elections will increase dramatically over the next two months. The traditional views that’s Republicans are pro-business and Democrats are pro-spending will continue to be spoken. Within the U.S., the effects of the coronavirus will also be included in this discussion since the current Republican controlled Senate and President continue to delay stimulus and minimize the healthcare and economic crisis.

Across Canada, schools will be opening with new safety protocols instituted to prevent the spread of Covid-19. The success of these measures will be a test of whether typical activities that cut across the entire society and across demographics can resume safely. The U.S. is ahead of us in re-opening activities and provide insight to the potential results of our actions. Jerome Powell, Chair of the Federal Reserve said, “the thing that matters more than anything else is the medical metrics, frankly. It’s the spread of the virus”. Since our economy is closely tied to the U.S., we will be influenced by the U.S. election results and success against the virus. Also, our government officials and public health officers will continue to monitor our metrics closely as schools reopen this fall.The latest details from the Canadian Federal government on stimulus and economic assistance for individuals, businesses, sectors and organizations helping Canadians are available at https://www.canada.ca/en/department-finance/economic-response-plan.html