What happened in June?

Almost everyone has grown weary of Covid-19. The economic uncertainty it has created, the necessary health precautions, the personal isolation, and most of all the deaths that have devastated families. It is as important as ever to practice safety measures and to continue to withstand all of the pressures that everyone has faced to-date, and will continue to face.

It is apparent, based on the U.S. example, that the virus has not tired, but we have. We must limit our exposure to others and to places, we must physically distance and wear masks and wash our hands fastidiously. Confusing and contradictory advice is plentiful, please use trusted sources for information, like HealthCanada who has released the following guidelines:https://www.canada.ca/en/public-health/services/diseases/2019-novel-coronavirus-infection/prevention-risks/measures-reduce-community.html#fi

June 2020 started typically enough with the Bank of Canada holding its overnight rate steady at 0.25%, and the markets rose with the beginning of economic reopening in many American states. One month ago, predictions of a rapid economic recovery were almost universal. For example, the Markit Purchasing Managers’ Index (PMI) for Canada, the U.S., Eurozone and globally have regained their pre-Covid levels. The PMI measures the optimism of purchasing managers, and whether they believe their businesses are expanding or contracting. https://www.markiteconomics.com/public

The dependence of the Canadian economy on the United States cannot be overstated. The U.S. is Canada’s largest trading partner. A faltering American economy cannot be replaced in the short term, and perhaps never in the long term. We need the U.S. to recover so that we can too. Unfortunately, by the end of June any progress against the virus had been lost. Many U.S. states, and internationally, daily records for new cases were set. As July begins 50,000 new cases each day are diagnosed, 40 out of 50 U.S. states have new cases increasing and the hospitalization rate are rising to overwhelm capacity. https://www.nytimes.com/2020/07/02/world/coronavirus-updates.htmlhttps://www.nytimes.com/aponline/2020/07/02/business/bc-eu-virus-outbreak-global-1st-ld-writethru.htmlhttps://www.nytimes.com/2020/06/26/us/coronavirus-florida-texas-bars-closing.html

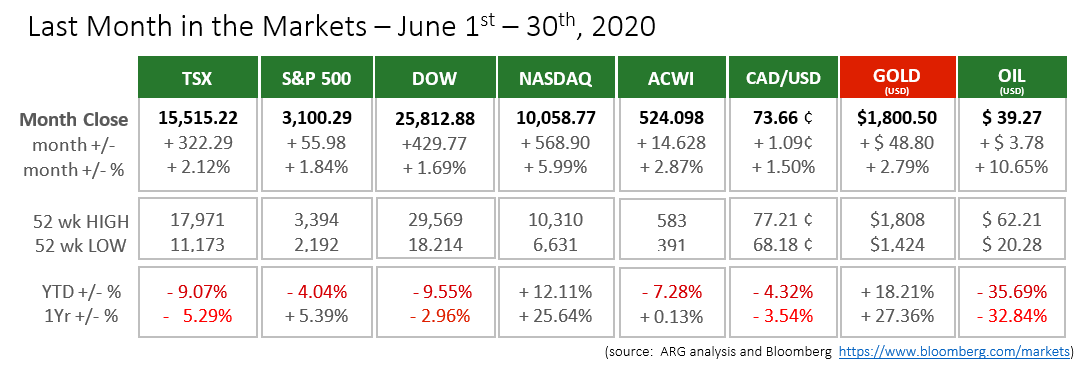

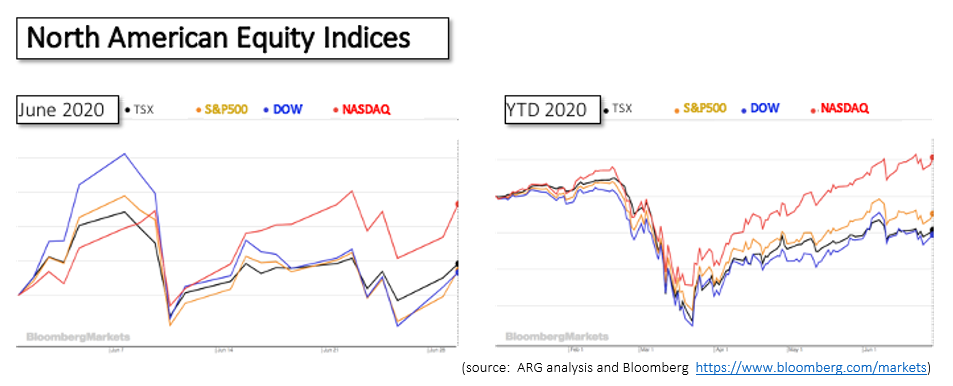

The progress stocks made during June was uneven, yet they ultimately finished ahead of the end of May. The NASDAQ has surpassed the highs of February and gained 12% in the first half of the year. The TSX and Dow are down 9% in 2020 and the S&P 500 has lost 4% this year.

The lowest valuations were achieved during the second half of March. Much progress has been made since then for all four major indices; especially the NASDAQ. Continued progress will rely on the success of measures and health outcomes on both sides of our southern border.

What’s ahead for July and beyond?

The most relevant economic information will be medical metrics of Covid-19 according to Jerome Powell, U.S. Federal Reserve Chair. Most economists and analysts are closely following the same virus data. https://www.cbsnews.com/news/coronavirus-economy-jerome-powell-federal-reserve-chairman-60-minutes/There are many different indicators and several interpretations of each. Excellent information on the number of new cases and hospitalizations, the two most important indicators, can be found on the New York Times website, and on Johns-Hopkins Covid summary. https://coronavirus.jhu.edu/map.htmlIn response to the negative news for individuals, families and businesses, the latest details from the Canadian Federal government on stimulus and economic assistance are available at https://www.canada.ca/en/department-finance/economic-response-plan.html

IMPORTANT DISCLAIMERSThis material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see a professional advisor for individual financial advice based on your personal circumstances.