What happened in January?

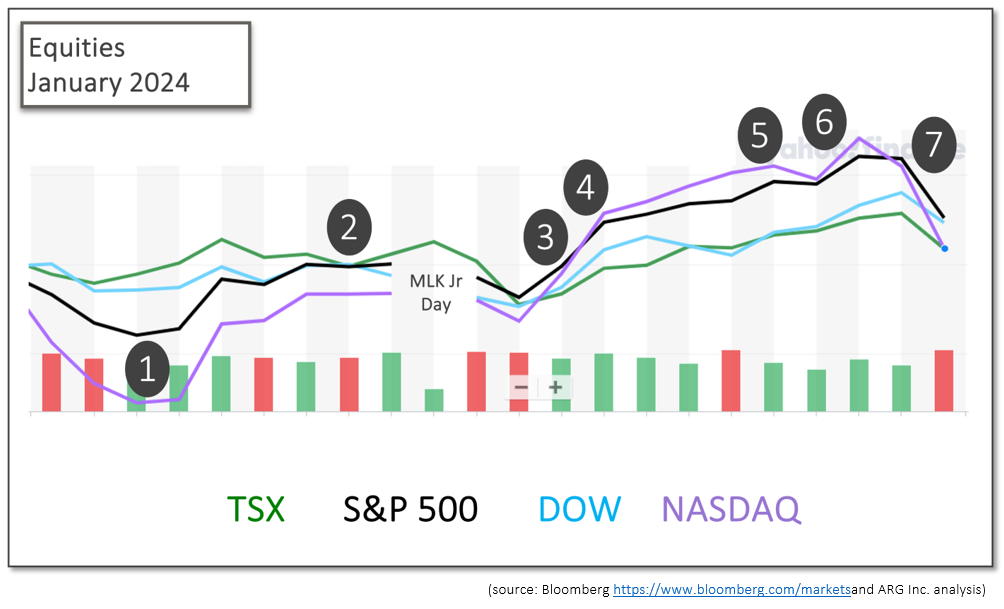

The month began with the S&P 500 hitting at new record high before settling downward as a strong U.S. jobs report cooled hopes for a Fed rate cut later in the month. Shortly afterward, inflation progress countered jobs data, and the S&P 500 and Dow reached new all-time highs during January. Most, but not all, of the news propelled American indexes to new heights, and dragged Canadian stocks along.

The annualized Consumer Price Index for December sits about ½ percent higher in Canada than the U.S. at nearly 4% and 3½%, which is well below previous levels, but not low enough to cause the Bank of Canada or the Federal Reserve to lower rates.

Many events contributed to the rise overall rise during the month for equity investors:

January 5th

The U.S. nonfarm payroll employment increased 216,000 in December, exceeding analyst expectations. The unemployment rate of 3.7% was based on 6.3 million unemployed persons in December. One year ago, the unemployment rate was 3.5%, and the number of unemployed persons was 5.7 million. BLS release CNBC

U.S. economy’s resilience has raised questions whether the Federal Reserve will lower interest rates as quickly as anticipated. After adding an average of 225,000 per month over the past year, the U.S. consumer demand and consumption may push inflation along. Strong jobs creation, typically, is good-news for equities in the short-term, but may not allow interest rates to fall further propelling the economy and equity values. Financial Post and jobs CNBC and jobs and rates

January 11th

The U.S. Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI) for December, and year-over-year inflation for calendar 2024. Consumer prices rose 0.3% in December, up from 0.1% in November. Over the past 12 months, the all-items index increased 3.4%, compared to 3.1% at the end of November. Over the past year the Core CPI decreased slightly to 3.9% from 4.0% at the end of November. BLS CPI release

January 18th

After a short period of tempering related to U.S. employment and inflation data, the S&P 500 set a new all-time closing high, and the Dow bested its previous record. This was the eleventh positive week for U.S. indexes out of the last twelve. This was not the only day that record highs were reached before a slight dip at the end of January.

U.S. equities were assisted by a legislative advance, when the U.S. Congress approved another stop-gap spending bill to keep the federal government operating until the beginning of March. The upcoming schedules for the House and Senate almost certainly guarantee another threat to government operations leading up to the March 1st and 8th. WaPo and spending bill

January 19th

The Canadian Consumer Price Index (CPI) rose 3.4% on a year-over-year basis in December, after the same reading sat at 3.1% in November. Contributing to the annual inflation rate were increases for gasoline, fuel oil, airfares, passenger vehicles, rent and groceries. For the month the CPI fell 0.3% in December, after a 0.1% gain in November. Gasoline contributed to both the annual increase, and the monthly decline in consumer inflation. Gasoline prices fell for the fourth consecutive month but remain above the level of December 2022.

The path of inflation will guide the Bank of Canada’s interest rate announcements scheduled over the next few months. CPI Annual Review StatsCan and CPI CBC and CPI CityNews

January 24th

The Bank of Canada held its policy interest rate, the overnight rate, steady at 5%, the Bank Rate at 5¼% and the deposit rate at 5% and continued its program of quantitative tightening. “Global economic growth continues to slow, with inflation easing gradually across most economies. While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment.” “Governing Council wants to see further and sustained easing in core inflation and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.” BoC release and MPR

January 25th

Based on Gross Domestic Product (GDP) growth the American economy grew faster than expected for the quarter and the year, and inflation cooled for December and 2023, according to the Bureau of Economic Analysis. In the fourth quarter GDP increased at a 3.3% annualized rate, and the rate of economic growth for the entire year of 2023 was 2.5%. The higher growth for both the quarter and year are linked to strong consumer and government spending.

The Personal Consumption and Expenditure price index (PCE), which is the Federal Reserve’s primary inflation measurement, rose 0.2% in December and 2.9% for 2023. Including food and energy headline inflation rose 2.6% annually at the end of December. The annualized rate of inflation is approaching the Fed’s low-term average goal of 2%, which will require inflation to fall under 2% to average-out the extended periods of high inflation that has been experienced.

Higher than expected growth and lowering inflation are defying the logic of many economists that had predicted that the U.S. would experience a shallow recession as a by-product of rising interest rates enacted to combat inflation. BEA GDP release CNBC and GDP BEA PCE release CNBC and PCE

January 31st

On the last afternoon of the month the Federal Reserve released its monetary policy update. Interest rates were held steady by the Fed, and the course of quantitative tightening continues, which matched market and analyst expectations. The next Fed interest rate announcement is scheduled for March 20th, and as of February 1st the likelihood of an interest rate cut is 46%.

In one of their shortest written statements, the Fed communicated “Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.” The statement suggests that the Federal Reserve’s interest rate committee, the FOMC, believes that the U.S. economy is performing well enough that it does not need monetary policy stimulus at this time, and that such stimulus could add to the higher than desired rate of inflation. CME FedWatch Fed release and presser

What’s ahead for February and beyond?

January concluded with a Federal Reserve interest rate announcement, and just a week earlier than a Bank of Canada update. As news of the fight against inflation continues to drone on, the path of interest rates will drive markets throughout 2024. Once central banks in North America begin to lower rates, as they are expected to do in 2024, the static string of boring updates will gather more excitement, and likely effect, depending on the element of surprise.

The timing of the next two interest rate announcements from the Bank of Canada (March 6th and April 10th) and the Federal Reserve (March 20th and May 1st) alternate with the Canadian policy-makers preceding the Americans by 14 and 21 days. Markets have priced-in a rate reduction from the Fed on March 20th, and the Bank of Canada will need to respond-in-advance. Expect the Bank of Canada’s rate reduction to foreshadow the Fed’s move, should it occur.

The other indicator propelling monetary policy is employment. Employment growth has slowed in Canada, as new job creation has ceased as of the last announcement, and immigration effects and labour market participation have driven the unemployment rate higher. In the U.S. the jobs market is still strong with the most recent monthly reading just slightly below the average.

Both the timing of announcements and the economic realities for inflation and jobs has analysts believing that the Bank of Canada could lower rates before the Fed does. It is not a certainty for either March or April, but consensus is growing that by June Canadian rates will begin to come down. CBC and BoC rates