Get a copy today

Click below to download a copy of our COVID Economic Response Information Package. Valuable information regarding everyting COVID related.

What happened in July?

In Canada much of the press’s focus on the federal government has been aimed at the Liberals’ approval of “the WE deal” to manage its student volunteer/aid program. Both Prime Minister Trudeau and Finance Minister Morneau did not recuse themselves from the discussion and decision despite existing beneficial arrangements for them individually and their immediate family members. It could have been somewhat reassuring to return to more normal issues; unfortunately the time and energy wasted on this scandal should have been directed at the pandemic. Quickly the contract was cancelled, money paid ($30 million) is being returned, major corporate sponsors have ended their relationships with the WE charity, the charity’s leaders and their leadership are under intense scrutiny, and politicians have been chastised publicly during Question Period in the House of Commons. All of this occurred while the coronavirus pandemic continues to ravage lives, families and economies.

In a financial snapshot released by Minister Morneau last month, the federal deficit has been projected to be $343 Billion for fiscal 2020-21 (a ten-fold increase since the last projection made in December 2019), the overall debt has been projected to be $1.2 Trillion, and 2020 GDP is expected to fall by 6.8%. https://www.canada.ca/content/dam/fin/publications/efs-peb/homepage/EFS2020-eng.pdf

Our elected officials have had to make major decisions based on incomplete information. With their leadership, Canadians have fared well from a public health perspective, despite 120,000 Covid-19 cases and 9,000 deaths. Creating a scandal that could have been easily avoided in the middle of a pandemic will be remembered, especially during the next federal election campaign.

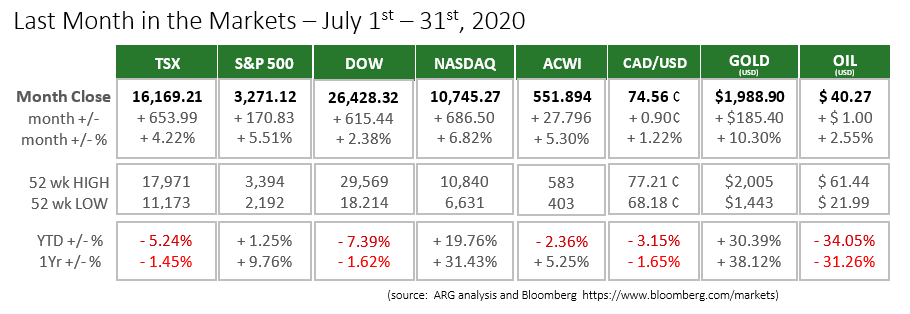

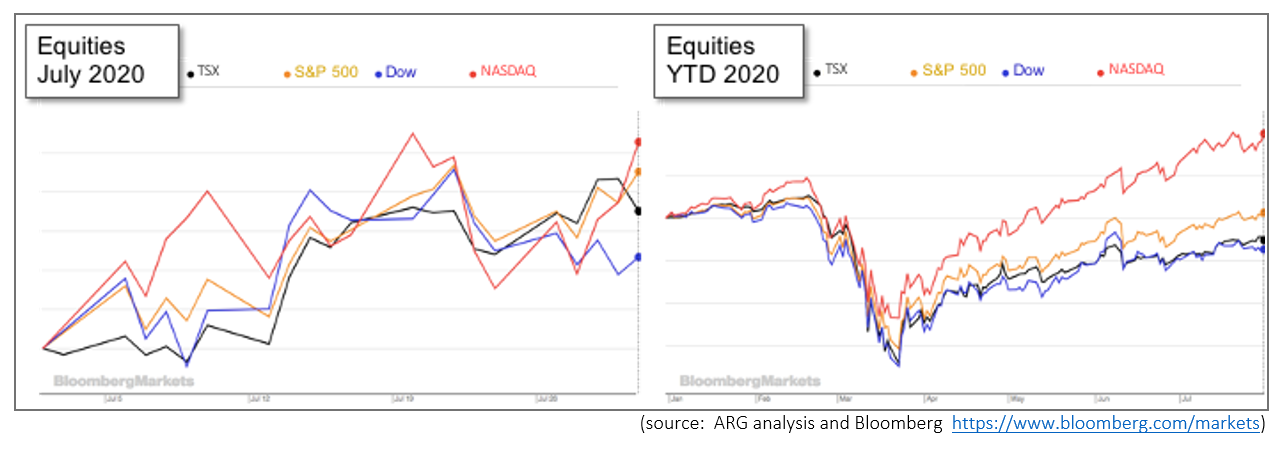

Despite the WE distraction and rising case counts and deaths in the United States, it was an all-green month for our grid above. Not only did equities finish July ahead of its start, but our dollar, gold and oil also gained. During the month, equities suffered some choppiness. Generally, indices peaked in the middle of the month, and then struggled to regain those levels over the last two weeks.

The TSX regained 4% more of its March losses in July but has still lost 5% year-to-date. The S&P 500 rose 5½% last month and moved above its year end levels. The NASDAQ has gained more than 19% this year after posting a gain of almost 7% last month. It has also surpassed its February peak, and reached new all-time highs. The Dow is currently the laggard among major indices in North America, falling behind our TSX in July gains, year-to-date performance and 1-year returns. The Dow is comprised of 30 large corporations that trade on American stock exchanges. It is not difficult to imagine that large firms that are less agile have suffered more than technology or smaller companies. https://finance.yahoo.com/quote/%5EDJI/components/

All of this occurred as the price of gold reached a new high at over $2,000 USD. Even as equities rose, the demand for a safe-haven investment like gold drove its price

What’s ahead for August and beyond?

The course of the pandemic will ultimately guide our economic and investment performance. To start August there appears to be some optimism despite the most recent news in the U.S. Ongoing political debate has ended weekly support payments for individuals as a new program is contested. Daily case counts may be falling slightly, but they are well above April peaks. Community-spread has reached smaller cities and rural areas. In 2016 Trump won “the counties” outside major urban areas by wide margins to win the Presidency. A direct threat on his base of support could cause a change in political tactics that may also benefit public health. https://www.nytimes.com/2020/08/04/opinion/covid-rural-hospitals.html

The dependence of the Canadian economy on the United States cannot be overstated. The U.S. is Canada’s largest trading partner. A faltering American economy cannot be replaced by Canada in the short term, and perhaps never in the long term. We need the U.S. to recover so that we can, too. The border between the U.S. and Canada closed on March 21st and will be closed until at least August 21st, when reopening beyond essential travel could occur.

In response to all of the negative news for individuals, families and businesses, the latest details from the Canadian Federal government on stimulus and economic assistance are available at https://www.canada.ca/en/department-finance/economic-response-plan.html

IMPORTANT DISCLAIMERS

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see a professional advisor for individual financial advice based on your personal circumstances.