The numbers don’t lie

At the end of the day, every investor has the same basic goal: To maximize their asset growth. But while it may sound simple on paper, this seemingly straightforward task is often anything but.

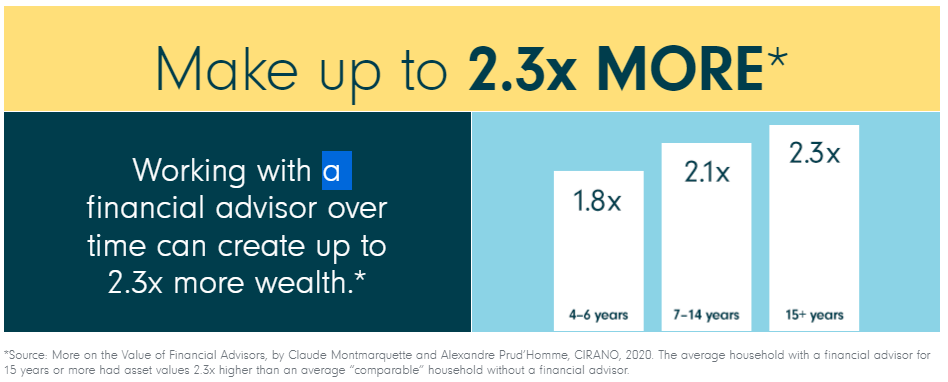

To succeed, you need to be disciplined, future-focused and well-versed in wealth accumulation. And as the research shows, it also helps to have an experienced financial advisor by your side. Consider these statistics:

Working with a financial advisor for four to six years can lead to 1.8 times more household financial assets (compared to going it alone) When you work with a financial advisor for seven to 14 years, that number jumps to 2.1 times more household assets After 15 years or more, your asset increase can be 2.3 times higher Simply put, a reputable advisor keeps you focused on reaching your goals and helps you make informed financial decisions— which, in turn, allows you to save more and respond swiftly to financial challenges and opportunities as they arise.

A trusted resource

Financial advisors have seen it all—and they put that expertise to work for you. Not only are they able to offer unique insights and suggestions to help you grow your assets, but they can also help you take control of your financial future.

A level-headed partner

It’s often helpful to view your financial advisor as a financial compass of sorts—a guide on your financial journey. Because they view your household wealth through an impartial lens, they support you by:

- Acting as a reliable sounding/discussion board for your ideas

- Working with you to alleviate worries that keep you up at night

- Anticipating future changes and proactively working through them with you

Navigating tax terrain

To get the most out of your investments, it’s important to minimize the taxes you pay. A financial advisor can improve your tax returns and limit your tax liability both now and in the future by directing you towards things like income-splitting opportunities, tax-efficient products, and registered and non-registered investment plans.

Staying ahead of evolving life events

As life moves on, your investment needs and requirements will inevitably change. Your financial advisor not only knows which life events are worthy of attention, but they can help you by:

Reviewing and recommending life insurance policies to protect your family Identifying ways for you to make effective use of RESPs Helping establish your will, retirement, estate and business succession plans Assisting you with your RRSP and spousal RRSP strategies Providing advice on how to efficiently transfer wealth to the next generation

Discover the Assante difference

If you know someone who isn’t working with an advisor, it’s time to share this data!