What happened in August?

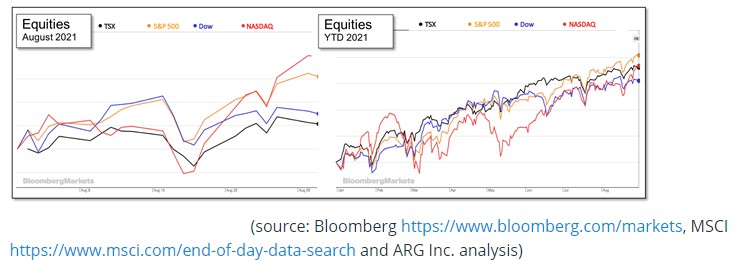

Overall, it was a positive month for most Canadian investors. The broad-based North American equity indices rose, as did the All-Country World Index (ACWI), above. August gains for these indices ranged between 1 and 4 per cent. The large corporates represented in the Dow performed the worst at a still impressive 1¼% improvement while the tech-heavy NASDAQ topped out at exactly 4% more than its July closing level. The NASDAQ had been lagging behind its peers, but the second half of August has allowed it to catch and surpass the Dow, TSX and ACWI.

The range for Year-to-Date performance for equity indices has risen to between 15 and 20%, which is an extremely healthy gain in any year. Also remarkable since only 8 months (two-thirds) of a news-filled 2021 have passed. August was the fourth consecutive month that equity indices started well, then suffered a mid-month dip, before regaining their footing and finishing in positive territory.

The influences over capital markets last month were many and varied:

- U.S. Gross Domestic Product (GDP) has grown 6.4% during 2021

- Canadian GDP grew by more than 5% in the first quarter before the announcement that it had shrank by 1.1% in Q2. Analysts had expected further growth of 2.5% during the second quarter. The Canadian economy is suffering from supply-chain shortages, which caused it to miss vehicle production and export targets, for example. The Canadian dollar reacted slightly to this news, but has already dropped in value against the U.S. dollar prior to the GDP news https://www.theglobeandmail.com/investing/markets/inside-the-market/market-news/article-canadian-dollar-retreats-after-surprise-gdp-contraction-in-second/

- July job growth has been strong in both countries with 94,000 new jobs in Canada and 943,000 in the U.S. The unemployment rate in Canada has fallen to 7.5% and 5.4% in the U.S.

- The U.S. consumer inflation rate for July was 5.4%. The core inflation rate that excludes food and fuel rose 4.3%, which was slightly lower than June’s year-over-year increases.

- The U.S. Senate passed a bipartisan infrastructure bill of $3.5 Trillion package.

- In Canada the spending continues to accelerate by the governing Liberals. The trend could be in jeopardy if their negotiated mandate with the NDP ends following the next election.

- Oil fell for the month despite mostly positive news on the demand-side

- A primary driver in the rise of equities at the end of the month was the announcement on Friday, August 27th by the Chair of the Federal Reserve, Jerome Powell. His remarks came at the conclusion of the annual Jackson Hole Symposium. Some changes are on the horizon for monetary policy but are not imminent. Consistency, and lack of unpredictability, typically provides positive momentum to markets

- The Fed’s current program of buying $120 Billion in bonds each month, which injects liquidity into capital markets, will likely be “tapered” by the end of the 2021. The liquidity (along with low interest rates) encourages personal and corporate borrowing and spending to fuel further economic growth.

- The need to temper inflation with an interest rate increase is being handled with extreme care. The major concern is that a rate rise now will cause lasting damage to a temporary, pandemic-recovery related period of price increases. The need to act is reduced because inflation is limited to a narrow band of goods and services, the areas with the highest inflation are moderating, wages are not positioned to support further inflation growth. https://www.federalreserve.gov/newsevents/speech/powell20210827a.htm

More uncertainty is likely to arrive soon as the extent of the Delta variant’s virility becomes better known, the reactive vaccine mandates begin enforcement, and the return to school for mostly unvaccinated children occurs. More uncertainty requires more planning, not less as some people believe. The monitoring of local and global events and their impact on markets will continue to be monitored. If additional attention is needed, do not hesitate to contact our office.