What happened in September?

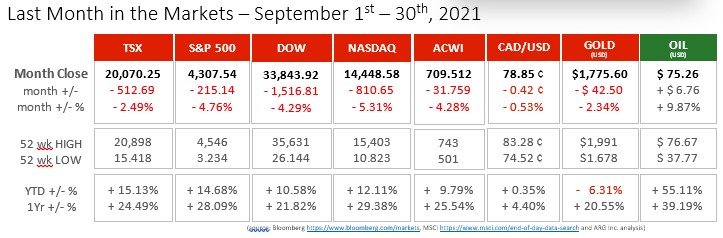

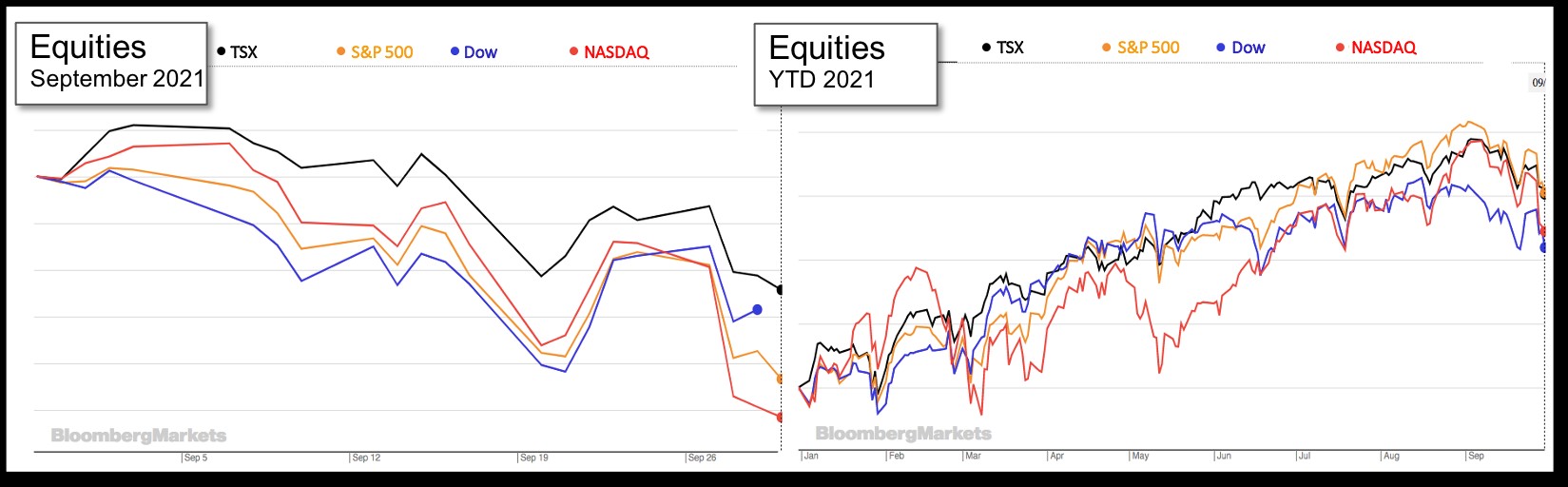

It was a difficult period for equities in North America and around the world last month. Oil gained strongly. American indices gave back 5% of their Year-to-Date gains, dropping them back from their former levels of 15-20% for 2021. Recently equity indices have been rising early in the month, dipping midway and then recovering and achieving a gain for the month. Unfortunately, September started poorly, dipped further and finished the last few days of the month with more losses.

The influences over capital markets last month were many and varied:

- The announcement of Canadian jobs growth was stronger than the weak expectations as 90,000 jobs were added during August, the unemployment rate fell from 7.5% to 7.1%. However, 200,000 less jobs exist now than in February 2020

- To continue to bolster our economy the Bank of Canada left its supportive monetary policy actions unchanged. The Bank Rate is ½%, and the overnight rate and the deposit rate have been held steady at ¼%. The bond buying program also remains unchanged. This signaled that the economy has not recovered significantly to trim monetary supports. BoC Announcement

- Inflation in Canada surged to its highest level since 2003 as prices in August rose 4.1% compared with a year earlier. August becomes the fifth consecutive month where inflation exceeded the Bank of Canada’s target annualized year-over-year rate of 2%. Our central bank still maintains that this heightened inflation level is temporary. When measuring inflation since the start of the pandemic the overall rate is only slightly above the Bank’s 2% target.

- The Liberals led by Prime Minister Trudeau were reelected to the same minority government that it had prior to Monday’s Canadian federal election. They did gain an additional two years, potentially, to their mandate. A significant plank in their election platform is to increase taxes on Canadian major banks, which nearly every Canadian investor owns directly and indirectly. Election Summary

- A lingering condition that has been influencing economic growth is supply-chain disruptions. As businesses reopen and attempt to return to full production, the availability of raw materials and component parts has not been universal. For example, the backlog of vehicles is large as the shortage of computer chips prevents the delivery of fully finished new cars and trucks to buyers. Recently automakers have announced plant closures and layoffs until the supply chain issues are resolved. Similar situations are found all across the economy, and until it is resolved, the return to full production will be difficult.

- In the U.S. their year-over-year inflation rate fell slightly from 5.4% in July to 5.3% in August. The month-to-month inflation rate also declined. Prices rose 0.3% in August compared to July, down from 0.5% for the period of June to July. This very slight moderation, and the lower core rate of inflation at 4.0% for August versus 4.5% for July, supports the Federal Reserve’s position to maintain current programs.

- The U.S. Federal Reserve kept its monetary policy for interest rates and bond-buying unchanged in its announcement on Wednesday, but indicated, “If progress continues broadly as expected the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” Any change that reduces support for economic growth, in this case measures to keep long-term borrowing costs lower, will negatively affect markets in the long term. Fed Press Release

- Political negotiations over the federal government’s debt ceiling were concluded at the final moment with an extension into December. Focus returns to President Biden’s centerpiece infrastructure bill, which could provide significant fiscal stimulus for economic activity as monetary stimulus may be reduced.

- Concerns that China’s housing and property developer, Evergrande, could default on interest payments triggered and/or contributed to a decline in equity indices. Evergrande’s $300 Billion debt load and $100 Billion in real estate sales last year represent a significant concentration risk but should not threaten the stability of the global banking system.

What’s ahead for October and beyond?

The list above suggests that many items could influence capital markets and balances in investment accounts. The major indicators that affect overall markets are economic growth measured as Gross Domestic Product, inflation through the Consumer Price Index (CPI), employment (monthly new jobs, unemployment rate), and monetary policy by central banks (interest rates and bond-buying) since these will affect corporate performance. Other unpredicted shocks can occur (like the pandemic), but the major economic indicators are an excellent place to begin your analysis and limit your preoccupation. Trust investment professionals who monitor economic indicators, and local and global developments continuously.