What happened in June?

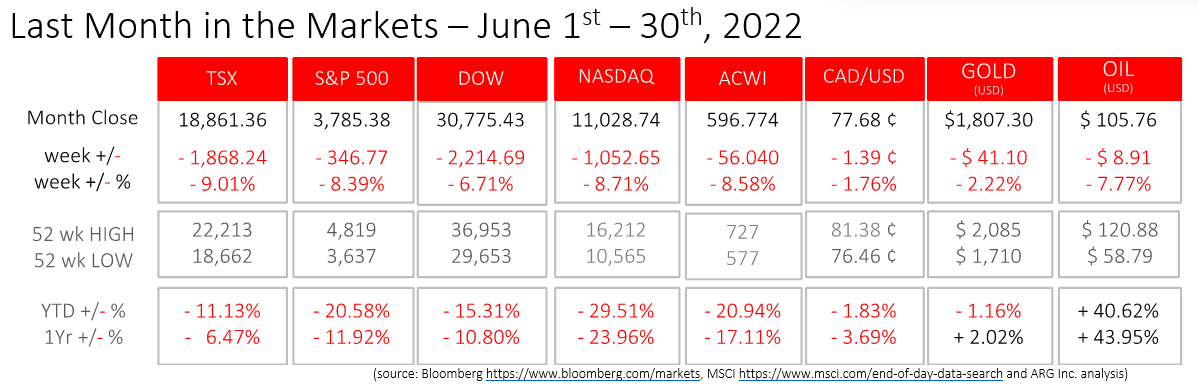

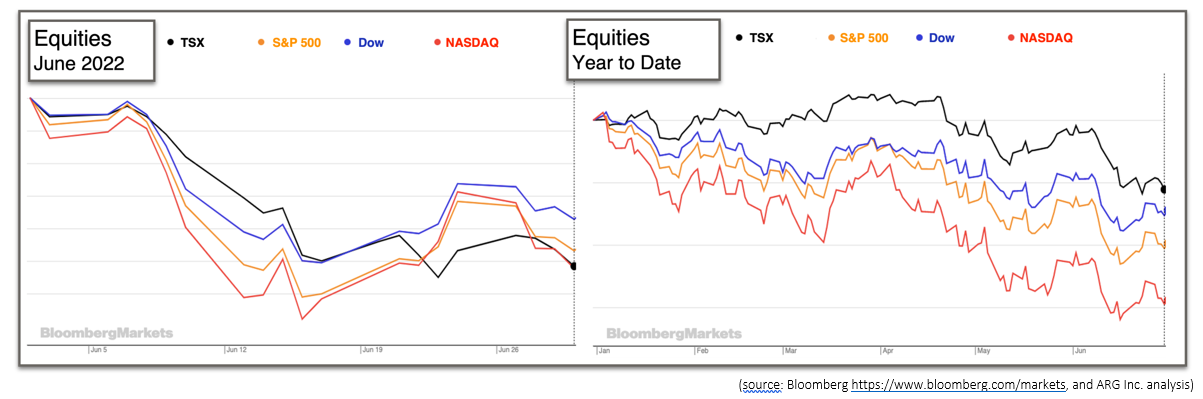

There is no denying that June 2022 was one of the most negative one-month periods in North American history for equities. The broad-based S&P 500 lost more than 8.4% of its value, the small-market and broad-based TSX lost 9%, the technology heavy NASDAQ split the difference at 8.7%, while the Dow dropped by 6.7%. Investors who have solely Canadian denominated securities lost 1¾% in foreign exchange losses as the Canadian dollar fell after holding its year-to-date value steady against the American dollar after the first five months of 2022.

Gold has held its value compared to one year ago even after losing more than 2% in June. Oil, like most other commodities, has given back some of its value, but remains well ahead of the start of this year and year-over-year.

At the end of the first week of June it was announced that the U.S. economy had added 390,000 jobs in May, a month where 330,000 people rejoined the labour force. Additional job seekers are an indicator of a strong jobs market suggesting that wages are rising above expectations and job finding is becoming easier. The elimination of pandemic restrictions and government support is also contributing to the return of workers to the labour force. Lastly, the U.S. unemployment rate remained unchanged at 3.6%, a historically low level. BLS Announcement

In May, the unemployment rate in Canada fell 0.1% to a record low of 5.1%. Employment rose by 40,000 when full-time work increased by 135,000 and part-time fell 96,000. Wages have risen 3.9% over the past year. Increasing wages and the transition from part to full-time employment is encouraging news for workers as the number of jobs and labour force participants exceed February 2020 levels. StatsCan release

The U.S. Consumer Price Index (CPI) rose 1.0% in May and the annual inflation rate sits at 8.6%. Again, the sub-indexes for food and energy were major contributors to the overall inflation rate, rising 1.2% and 3.9%, respectively, during May. The rise of these two categories is significantly higher than the increases experienced in April. The inflation rate for “all items less food and energy” rose 0.6% in April and again in May, and this flattening was a small measure of positive (or at least not negative) news. BLS release

Consumer inflation in Canada rose in May to 7.7% year-over-year (YOY), an increase from the April YOY level of 6.8%. On a monthly basis inflation rose 1.4% in May, more than double the monthly increase of 0.6% experienced during April. StatsCan inflation

Inflation is not just a North American problem. In 16 of 44 advanced economies, the rate of inflation in the first quarter of 2022 has quadrupled compared to Q1 2020. In stark contrast is China’s CPI of 2.1% for May, which has been heavily influenced by strict Covid-19 controls. “The modest price pressures also allow China’s central bank to release more stimulus to prop up the economy even as monetary authorities in most other countries scramble to hose down inflation with aggressive interest rate hikes”. For example, the European Central Bank left its interest rates unchanged last week but intends to raise them by ¼ percent (25 basis points) in July. China inflation article ECB Pew Research

The Federal Reserve raised the federal funds rate by 75 basis points on June 15th. An increase of this magnitude had not occurred since 1994, signifying the severity of the situation. The rate now lies in a range from 1.5 to 1.75%. At the press conference to announce the increase, Federal Reserve Chair, Jerome Powell, stated that the Fed, “anticipates that on-going increases in that rate will be appropriate”. To-date in 2022 the Fed has increased the rate by 1½%.

In eras of volatility, and when volatility is low, disciplined investing has been proven to be the best long-term strategy. The equity markets have been volatile, and negative, for 2022 and retirement portfolios deserve discipline. https://www.schwab.com/learn/story/panic-is-not-strategy-nor-is-greed

The first half of 2022 has mercifully concluded, especially those who are heavily invested in North American equities after the major indices have lost 11% to 29% of their value this year

The S&P 500 is in a bear market having lost 20%. This index provides a more balanced view of the broad issues facing American equity prices than the tech-heavy NASDAQ or the major corporates of the Dow.

What’s ahead for July and beyond?

The second half of 2022 should provide more promise than the first half delivered for North American focused equity investors even as the factors contributing to pessimism for corporate performance and declining share values remain. Inflation will continue for several quarters, at least, until monetary policy and quantitative tightening work their way into the economy. Global supply chain issues continue, exacerbated by the ongoing war in Ukraine, which has also fueled inflation. Although new threats will emerge current concern has already been priced-in to the markets

The non-farm payrolls data, which will be announced near the beginning of July, along with any progress against inflation will heavily influence markets and central bank actions to control it.