What happened in April?

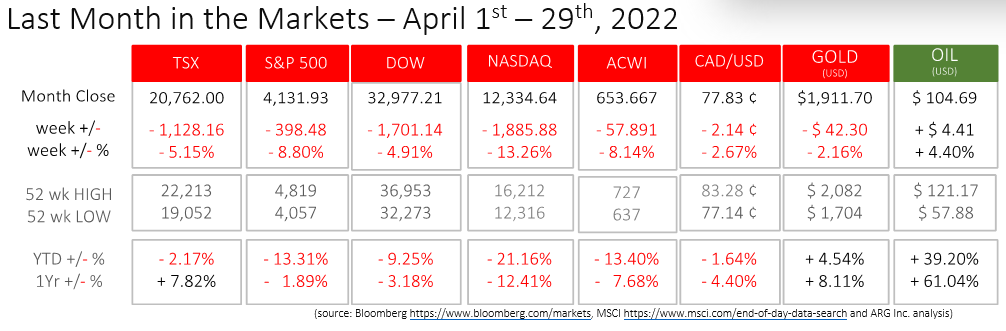

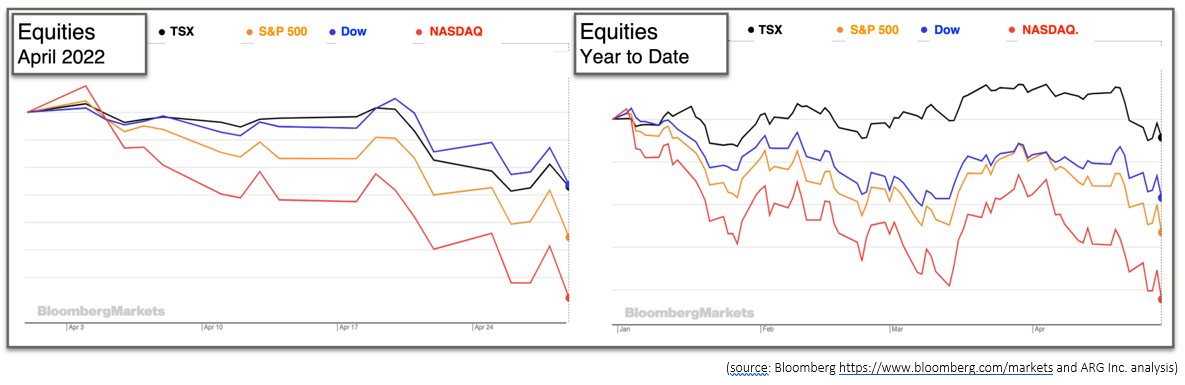

The month began on a positive note for North American equity indices, unfortunately, the high-water mark was reached on the first Monday of the month. With only a couple of exceptions, the remainder of April delivered additional losses for equity investors. Additionally, the Year-to-Date graph, below, shows that the indices are all following the same pattern, but at slightly different levels of success.

The resource linked TSX was the last to move into negative returns for Year-to-Date. The TSX is still performing best among diversified North American indices due to the rising price of many commodities, slightly behind the 30 constituents of the Dow. The technology-heavy NASDAQ has suffered from the rise of in-person work and less shelter-in-place as pandemic restrictions are lifted.

Overall, the investing landscape has changed in 2022 and over the past year. The onset and continuation of the pandemic brought significant uncertainty to capital markets. The current period contains new and different challenges for investors and some of the lingering issues like supply chain disruptions. The factors that are driving equities downward, and other asset classes upward include:

- Programs and conditions to drive economic growth are being pared back. Interest rates are being increased by central banks. Employment is being maximized while inflation runs high. Since employment has exceeded pre-pandemic levels and inflation continues to rise central banks need to slow growth to temper inflation.

- Russia’s invasion of Ukraine and the geopolitical, energy and resulting supply chain uncertainty

- The resurgence of the pandemic and resulting lockdowns in China are threatening growth in the world’s second largest economy

The likelihood of an interest rate increase by the Bank of Canada in April was supported by the Canadian employment report for March. 73,000 jobs were added, and the unemployment rate fell by 0.2% to 5.3%. This is the lowest unemployment rate since 1976 when similar data was first collected and analyzed. Labour Force Participation remained unchanged from February at 65.4%, total hours worked rose 1.3% and wages have risen 3.4% compared to March 2021. As restrictions are lifted the percentage of employees who work exclusively from home fell 1.8% to 20.7%. https://www.cbc.ca/news/business/jobs-march-canada-1.6413073 https://www150.statcan.gc.ca/n1/daily-quotidien/220408/dq220408a-eng.htm?HPA=1

On April 7th, Minister of Finance, Chrystia Freeland, presented the governing Liberals latest budget, the highlights affecting Canadians’ finances include $56 Billion in new spending for national dental care, affordable housing incentives, reconciliation with Indigenous Peoples, increased defense, and climate initiatives. Also, a surtax on large banking profits and an increase to the corporate tax rate are included in the proposed measures. https://budget.gc.ca/2022/home-accueil-en.html

The Federal Reserve released the minutes from their mid-March monetary policy meeting that indicated committee members were taking a more aggressive stance against inflation than originally thought. The Federal Open Market Committee members unanimously agreed to raise the federal funds rate ¼%, and the market has priced-in an increase of about 170 basis points (1.7%) for 2022. The Federal Reserve will also allow close to $100 Billion in bonds to mature each month without being replaced. The removal of this money from markets will tighten long-term borrowing and increase costs and yields. With inflation expected to exceed 8%, and the robust jobs market and GDP growth, the U.S. economy needs price stability and no longer requires monetary support to fuel growth. FOMC Minutes

On April 13th the Bank of Canada raised its interest rates again in 2022 to slow domestic inflation. The rate was increased by ½%, which is the largest rate increase in more than two decades. The target range for the deposit rate to the bank rate is now 0.75% to 1.25%.

The U.S. Consumer Price Index (CPI) rose again last month. Since February, prices for consumers rose 1.2% and in the past year prices have risen 8.5%. Like preceding months, the largest contributors were gasoline, housing, and food. Energy costs have risen 32% over the past year, and groceries are up 10% since March 2021. The Producer Price Index (PPI) for March sits at 11.2%; the highest recorded year-over-year increase ever recorded for American companies. BLS CPI

StatsCan released the Canadian Consumer Price Index (CPI) data for March. Prices increased 1% during the past month and 6.7% over the past year. It is the largest, annual reading in 31 years. Gasoline has been a major contributor to the growing rate of inflation after rising more than 19% since February 1st. Rising inflation is further justification of the Bank of Canada’s interest rate increases. CBC NewsWhat’s ahead for May and beyond?

On May 4th, the Federal Reserve will announce its latest monetary policy to cool inflation, which is being driven by pandemic reopening, continuing supply chain disruptions, and geopolitical turmoil. The consensus among Federal Open Market Committee members as indicated in past meeting minutes suggests that multiple increases will occur in 2022 and larger increases will occur early this year before tapering as 2023 approaches. A half-point increase is expected for the federal funds rate. The Bank of Canada is scheduled to release its next interest rate announcement on June 1st.

Clear signals have been given by both the Fed and Bank of Canada of anticipated changes to monetary policy, and much of the most recent negative performance for equities reflects the “tightening” to come.