What happened in April?

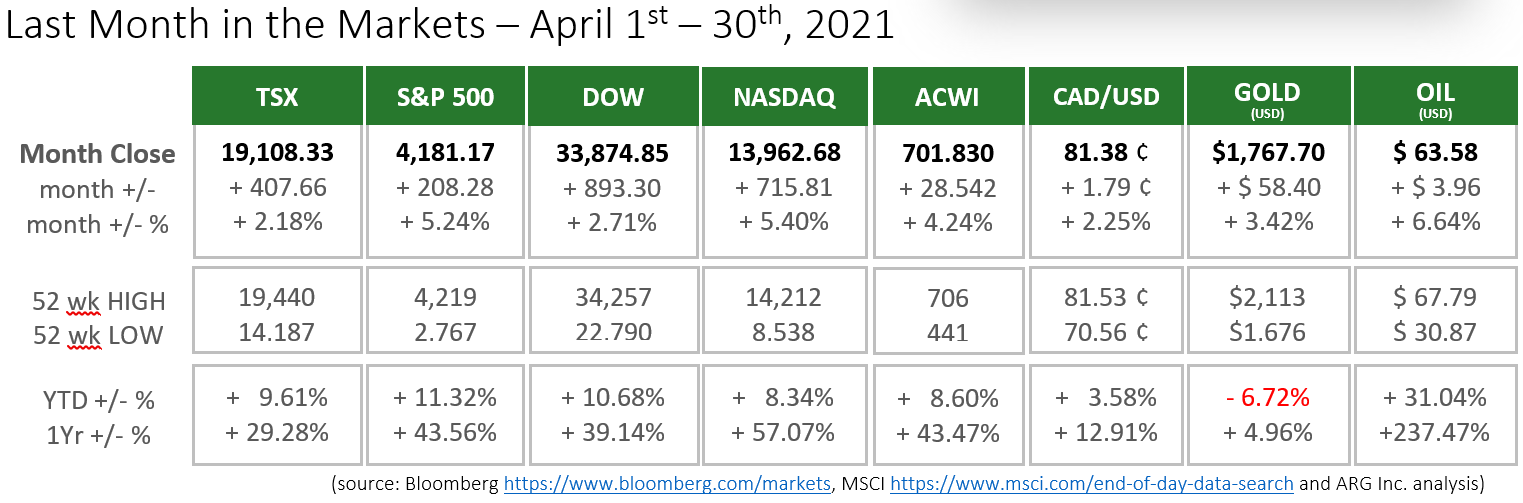

The month began with North American, European and many other markets closed for the observance of Good Friday on April 1st. When trading did begin the results were positive. The major indices rose 2 – 5% for the month, which is a strong performance by nearly any standard, despite difficulties during the month and on the final day of trading.

The first week ended very positively for North American and global equity investors. The broad-based indices of the TSX, S&P 500 and MSCI’s All-Country World Index achieved record highs. A number of contributing elements played a part:

- The US employment report that was released on Good Friday provided a positive start to the month. The Canadian jobs exceeded expectations for employment and job creation, too.

- Purchasing Managers Indices (PMI) from ISM for services companies indicated an increasing optimism for economic growth.

- The International Monetary Fund (IMF) increased its forecast for global growth to 6% from 5.5%

During the second week of the month equity indices reached new record levels again. Driven by strong economic data and falling government U.S. bond yields the TSX, Dow and S&P 500 reached all-time highs.

- The American and Chinese economies, the world’s two largest, are growing at accelerating rates based on recently released data for Gross Domestic Product, employment, consumer confidence and consumer spending.

- Another bellwether of an economy’s health is the earnings reported by banks. Reversing overly pessimistic reserves set aside for loan losses have led to stronger profits. US bank profitability

- The TSX was pushed higher by positive economic progress in the U.S. and China.

- The Bank of Canada (BoC) released its quarterly Business Outlook, which achieved its highest level since 2018. BoC BOS Spring 2021

Week 3 was a reversal when North American and global equities, the Canadian dollar, gold and oil fell.

- The results can be directly related to faltering success against the COVID-19 pandemic. Internationally, surges in cases in the less developed nations, particularly India and Brazil, and in more developed nations, like Japan have increased the likelihood of ongoing economic damage.

- The Canadian federal government released its first budget in two years that included $101.4 Billion in new spending to provide pandemic relief and position Canadians and businesses for future economic success. The budget deficit is projected at $354 Billion for the year ended March 31, 2021 and $155 Billion for the current fiscal year.

- The Bank of Canada (BoC) held its benchmark interest rate unchanged in its continued support for economic recovery. It has forecast Canadian Gross Domestic Product (GDP) growth for the first quarter at 7%. Based largely on this high rate of growth the BoC is planning to reduce it bond purchase program and has indicated that interest rates may increase sooner than earlier projections.

- The European Central Bank (ECB) kept its interest rates steady and indicated that bond purchases would be increased to support the collective Eurozone economy.

- All of these developments reminded markets of the pandemic’s effects.

Results were mixed for the last week of the month that left major indices mostly unchanged. A number of contradictory influences contributed to these results:

- Solid corporate earnings have been turned in for the latest quarter.

- President Biden continued to advance his economic recovery plan with several trillion dollars of spending. The bills introduced include the $1.8 Trillion American Families Plan (education, child-care and social supports), the $2.3 Trillion American Jobs (infrastructure) and the approved $1.9 Trillion American Rescue Plan (pandemic relief and stimulus).

- U.S. and Canadian economic expansion/recovery is occurring more quickly than first anticipated

- Canadian retail sales are rebounding more quickly than expected. As an example, Shopify which is a major component of the TSX, reported sales much higher (about double) and profits (almost triple) ahead of expectations.

- The Federal Reserve continues to support economic recovery despite a rise in the rate of inflation which could eventually cause interest rate increases. The Bank of Canada made a similarly toned announcement nearly two weeks ago.

- Pandemic case numbers are again rising in many parts of the world with the threat of renewed lockdowns and restrictions loom. India has had more than 400,000 cases daily while they experience shortages of critical supplies like oxygen.

All of this allowed the NASDAQ, S&P 500 and Canada’s S&P/TSX indices to reach all-time record highs during the week before falling back on Friday.https://www.nytimes.com/2021/04/29/business/economy/united-states-gdp.html

What’s ahead for May and beyond?

After another month the effects of the latest pandemic efforts will be seen. The co expansion of vaccination programs will oppose the increasing number, contagiousness and severity of virus variants as governments enact legislation to combat negative economic and public health outcomes.

At the present time many indicators are positive. Economic growth (GDP) in Canada and the U.S. is strong. Quarterly company earnings are exceeding expectations, especially for large consumer IT/internet firms like Facebook, Apple, Amazon, Microsoft and Alphabet (Google). Central banks continue to support recovery with monetary policy and have focused on promoting a rise in GDP, not inflation fears. Government fiscal policy, spending on stimulus, infrastructure and worker supports, have bolstered the economies in Canada and the U.S.

The latest pandemic support measures from the Canadian federal government can be found at https://www.canada.ca/en/department-finance/economic-response-plan.html