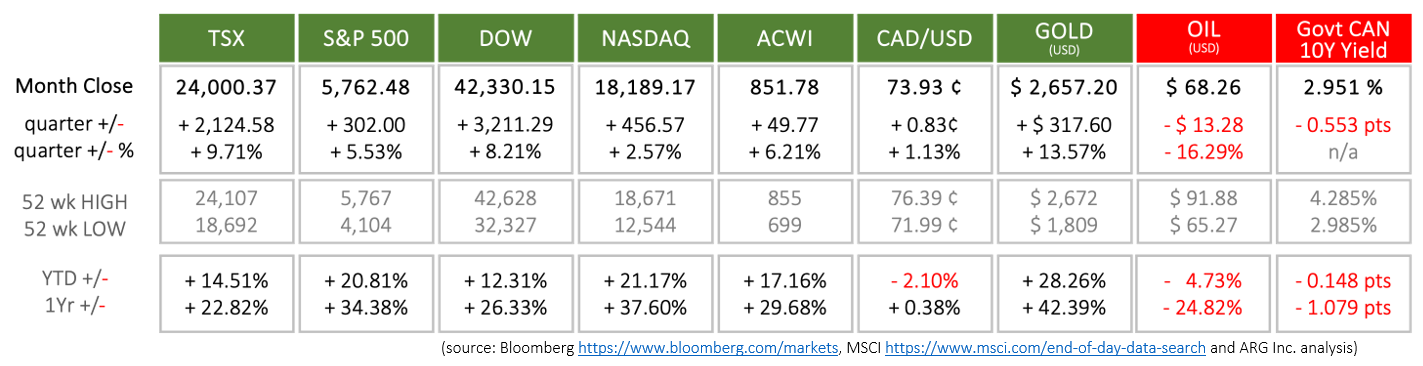

Last Quarter in the Markets: July 1st - September 30th, 2024

What happened in the Third Quarter?

The biggest news directly affecting markets was the Bank of Canada (BoC) and the Federal Reserve executing rate reductions. The BoC has cut their policy rate ¼ percent three times, totaling 0.75 percent. Although the Fed has only made one rate cut, it slashed the federal funds rate by ½ percent on September 18th.

It has been a prolonged process, but inflation and employment both finally reached levels encouraging expansive monetary policy from their respective central banks. As outlined, below, the Federal Reserve is poised to continue lowering rates should their dual mandates continue their trajectories. The Bank of Canada has made similar statements regarding their plans for rates. BoC press conference

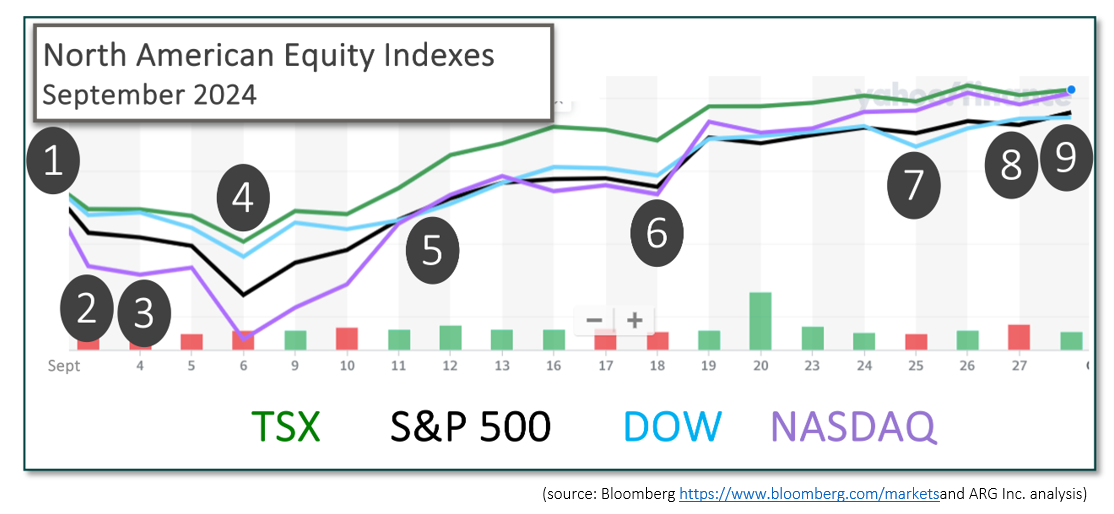

What happened in September?

For the second consecutive month, equity values ended much better than they began. North American equity indexes fell during September’s first week, reaching their lowest points for the month at the end of trading on Friday, September 6th. Starting on the 9th, it was essentially an uninterrupted run of gains over the next three weeks.

The notable events included:

August 30th

August concluded with less than positive news as U.S. inflation as core Personal Consumption and Expenditures price index (PCE) increased 0.2% in July and 2.6% in the past year. This news contributed to a decline for equities for the first week of September based on the belief that the Fed might act conservatively with its rate reductions. BEA PCE release CNBC and PCE

September 2nd

The first Monday of the month began with Canadian and American equity and bond markets closed for the observances of Labour and Labor Day, respectively.

September 4th

The Bank of Canada announced its third consecutive monetary policy update that reduced the overnight rate by ¼ percent (25 basis points). The target has been reduced from its July 2023 peak of 5 percent to 4 ¼ percent. BoC rate announcement CBC and BoC

September 6th

The Non-farm Payroll Report from the U.S. Bureau of Labor Statistics (BLS) showed employment increased by 142,000 in August, up from 89,000 in July, but below the consensus forecast of 161,000. The U.S. employment situation cleared the Federal Reserve to cut rates. BLS release CNBC and jobs CNN, jobs, rates, markets

September 11th and 12th

The all-items Consumer Price Index had increased 2.5 percent on a year-over-year basis. The increase was the smallest since February 2021, three and one-half years ago. In August, the prices for shelter (+0.5 percent), food away from home (+0.3 percent) increased, while the index for energy (-0.8) fell during. BLS CPI release

The Producer Price Index (PPI) was released one day after the CPI. Wholesale prices rose 0.2 percent in August, and 1.7 percent on a year-over-year basis. BLS PPI release CNBC and PPI

September 18th

Following the Bank of Canada’s lead over the summer and on September 4th, the U.S. Federal Reserve slashed the federal funds rate by ½ percent to a range of 4¾ to 5 percent. It was the first rate cut since March 2020. Fed release

The larger-than-usual rate cut suggests that the Fed has started is attempting to ensure a soft landing by avoiding a recession, and more rate reductions can be expected. CNBC and recession

As stated at the Fed's press conference , it appears that rates may be reduced again before the end of 2024, and another 1 percent in 2025 based on the Fed’s Summary of Economic Projections. The long-term expectation is that the policy rate will settle at 2¾ to 3 percent.

September 25th

Oil prices dropped as Saudi Arabia abandoned its $100 per barrel target. The Saudis will maintain production levels and seek to regain market share with lower prices, which is good news for consumers and companies relying on petroleum prices. A reduction in oil prices will also lower inflation globally, which should position central banks for more rate reductions. FT and oil

September 27th

Before North American markets opened, the U.S. Bureau of Economic Analysis released the latest inflation data. The PCE price index has rose 0.1 percent in August, and 2.2 percent on a year-over-year basis, down from 2.5 percent in July. It is the lowest annualized inflation rate since February 2021. The PCE is the Federal Reserve’s preferred inflation measure and suggests that the Fed will focus on its other mandate to maximize employment. BEA PCE release CNBC and PCE

September 30th

The month ended with the National Day for Truth and Reconciliation.

What’s ahead for October and beyond?

The likelihood of an early federal election triggered by a non-confidence vote has risen dramatically. Once the NDP left their alliance with the governing Liberals the Conservatives, Bloc and NDP have begun campaigning at Parliament’s Question Period. The political uncertainty could lead to additional market volatility for Canadian securities.