Last Month in the Markets: October 1st – 31st, 2025

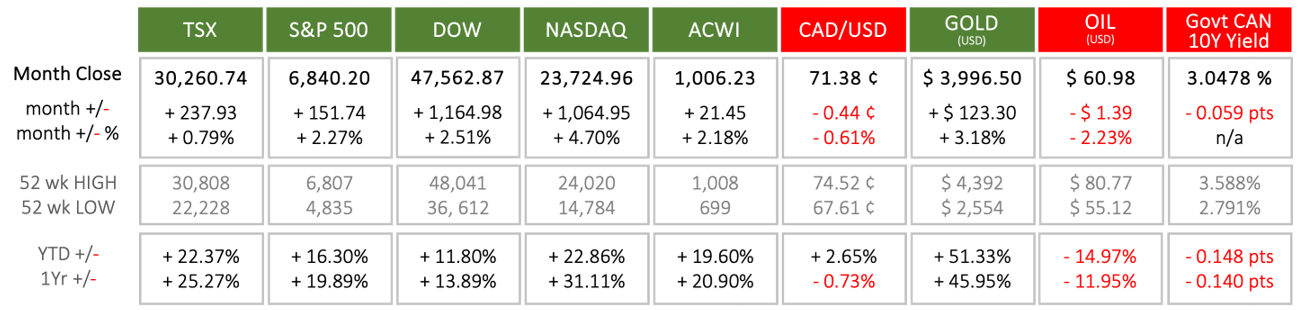

Index returns based on index value (source: Bloomberg https://www.bloomberg.com/markets, MSCI https://www.msci.com/end-of-day-data-search and ARG Inc. analysis)

What happened in October?

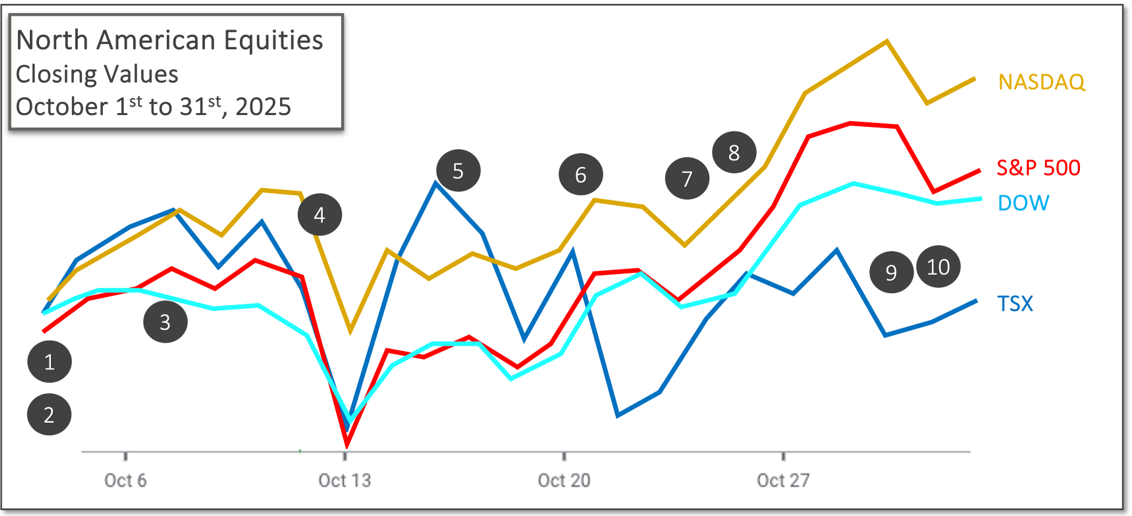

North American equity investors saw strong performance, especially those focused on the U.S. indexes. Although the TSX moved up nearly one percent, the American indexes moved up substantially more, with the NASDAQ delivering nearly five percent.

This performance came with an increase of uncertainty and volatility that spiked in the middle of the month. Further evidence of the resultant flight-to-safety was the peak closing price for gold on October 20th when it reached $4,359 USD.

The volatility peak, gold rush and a drop in equity index values all closely followed the beginning of the U.S. government shutdown that preceded trading on Monday, October 13th.

(source: Bloomberg https://www.bloomberg.com/marketsand ARG Inc. analysis)

Events that influenced markets in October included:

October 1st – U.S. government shut-down began

A government shutdown began after the U.S. Congress was unable to reach an agreement to extend funding to avoid the disruption of services and benefits. One of the casualties of the budget impasse was the scheduled Nonfarm Payroll Report from the Bureau of Labor Statistics. The payroll report is considered “the King of the Numbers” and is closely watched, along with interest rates and inflation, to inform traders. Reuters and shutdown

October 1st – Bank of Canada released its logic on mid-September interest rate cut

The Bank of Canada released its Summary of Deliberations from its September 17th ¼ point interest rate cut. Since the July Monetary Policy Report, “the global economy had proven resilient to increased US tariffs in the first half of the year, there were increasing signs that economic growth was slowing.” BoC SoD

October 7th – Canada’s trade balance affected by U.S. tariffs

Prime Minister Carney and President Trump met in Washington to discuss several issues, including trade between the two countries as Canada’s trade surplus with the U.S. fell from $7.4 billion in July to $6.4 billion in August. CBC and trade

October 10th – Canada’s employment numbers rebounded

StatsCan released the latest employment report. Employment increased by 60,000 in September, after declining by more than a combined 100,000 in July and August. The unemployment rate was unchanged by 7.1%. The turnaround from job losses to growth and an increase above analyst expectations is a positive sign for the health of the Canadian economy despite the on-going trade war and negotiations with the U.S. StatsCan employment report CPI and employment

October 16th – Market volatility peaked mid-month

The primary measure of volatility is the CBOE VIX Volatility Index. At the highest level since President Trump's Liberation Day, the VIX peaked at 25.31, one week earlier it was 16.43. The calculation of VIX is complicated, however the 54% increase in one week indicates how quickly and dramatically volatility rose based on Trump’s trade war and the government shutdown. To better understand VIX, values below 20 represent stability, and values over 30 indicate greater market fear and uncertainty.

October 21st – Canada’s consumer inflation moved up by one-half percent

StatsCan announced that the Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in September, up from a 1.9% increase in August. Economists had expected a rise of 2.2%. A slower decline in prices for gasoline and a larger increase in grocery prices conspired together to push the inflation rate higher. The Bank of Canada preferred inflation indicator set is Core CPI, which excludes food and energy. The three measures of Core CPI in September were 2.7%, 3.2% and 3.1%, with 3% as the goal. StatsCan CPI release CBC and CPI

October 23rd – Trump ended tariff negotiations with Canada, again

President Trump ended tariff negotiations on Thursday night in reaction to a campaign that includes a video advertisement that the Government of Ontario has been airing in the U.S. Trump has attributed the ad to Canada, not Ontario, which may have contributed to his decision to cease trade talks.

October 24th – U.S. consumer inflation moved upward

Despite the U.S. government shutdown the Bureau of Labor Statistics released CPI data for September. On a seasonally adjusted consumer prices rose 0.3 percent, slightly below the 0.4 percent measured in August. On a year-over-year basis the all-items index rose 3.0 percent versus 2.9 percent in August. BLS CPI release CNBC and CPI

October 29th – Bank of Canada and Federal Reserve cut rates

Monetary policy dominated the North American economic news with the Bank of Canada and the Federal Reserve releasing interest rate decisions on Wednesday. These central banks both made the identical decision to lower their policy interest rate by ¼ percent (25 basis points).

For the second consecutive announcement the Bank of Canada cut its overnight rate, which now sits at 2¼ percent. At the press conference, Governor Tiff Macklem’s asserted that monetary policy cannot undo the damage caused by tariffs, but the Bank would respond. The prepared remarks included “Canada’s economy contracted by 1.6% in the second quarter, reflecting a drop in exports and weak business investment amid heightened uncertainty”, “Canada’s labour market remains soft. Employment gains in September followed two months of sizeable losses”, and “CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated.” The Bank concluded, “With ongoing weakness in the economy and inflation expected to remain close to the 2% target, Governing Council decided to cut the policy rate by 25 basis points.” BoC release CBC and BoC

The U.S. Federal Reserve stated “Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year” and “Inflation has moved up since earlier in the year and remains somewhat elevated” as the government shutdown severely limited the dissemination of economic data. Nonetheless the Fed lowered the federal funds rate by ¼ percent to a range of 3¾ to 4 percent. Chair Powell stated that the Committee would continue to monitor economic indicators, which will be difficult with limited releases available during the shutdown, and that further rate reductions were not a forgone conclusion. Fed release CNBC and Fed

October 30th – European Central Banks held rates unchanged

The European Central Bank decided to maintain its interest rates since their consumer inflation has settled around their 2% goal and employment has stabilized. The effects of the trade war on European economies are more muted than on North American economies. ECB summary ECB release

What’s ahead for November and beyond?

The negotiations for the global trade war will continue to influence markets. U.S./China relations will have a global effect, and U.S./Canadian talks will directly affect values here, especially for companies or industries that export to the U.S.

The effects of tariffs on inflation and employment will guide central bank actions for interest rates.

Tuesday, November 4th will see the Carney led Liberals introduce a budget bill, which could provide insights for investors, although a promise of “no surprises” was made. Budget lead-up