What happened in September?

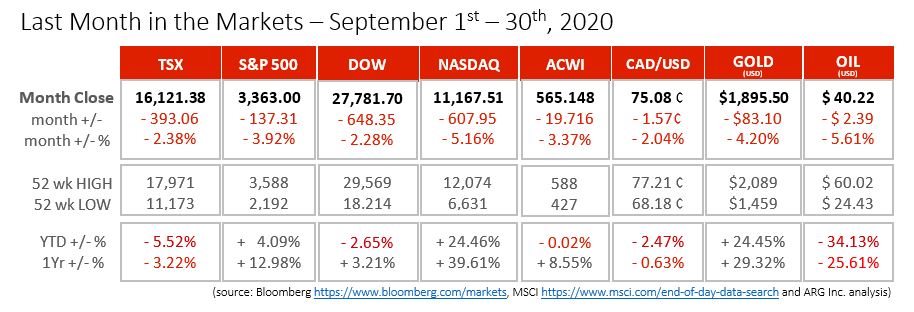

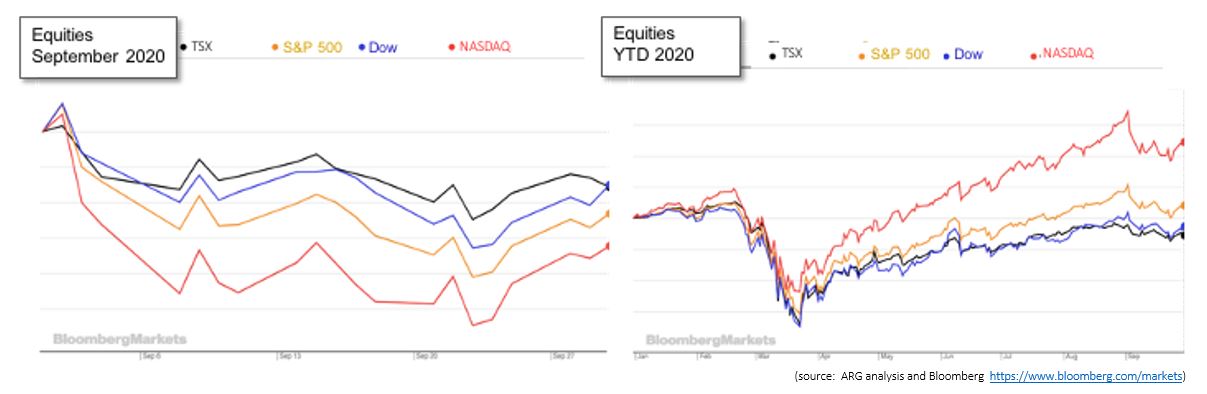

Equities reversed five consecutive monthly gains with losses in September. The last time the major North American indices lost value for an entire month was back in March. Canada’s TSX lost value for five weeks in late February and into March before its five-month winning streak. With the turmoil that has occurred since mid-March it is difficult to believe that each month from April to August had delivered month-to-month gains.

Despite the losses for the month, it ended positively. Each of the North American equity indices, above, hit their lowest values in September on the 23rd. Thankfully, by September 30th relief was delivered as the TSX, S&P 500, Dow and NASDAQ gained 1.9%, 3.9%, 3.8%, 5.0%, respectively.

The most recent Throne Speech was delivered on September 22nd in the House of Commons and presented an opportunity for the governing Liberals and other parties to demonstrate their willingness to work together while still representing their core beliefs. If compromises were not reached to allow a temporary coalition, the Liberal minority government would fall if a non-confidence vote passed. The leader of the NDP, Jagmeet Singh and Prime Minister, Justin Trudeau, negotiated a compromise centred on sick leave allowing the Liberals to stay in power.

https://www.theglobeandmail.com/politics/article-liberals-avert-fall-election-strike-deal-with-ndp-on-paid-sick-leave/

https://www.theglobeandmail.com/politics/article-federal-throne-speech-sept-23-explainer/

What’s ahead for October and beyond?

Most of us had hoped that we would be enjoying a greater return to normalcy by autumn. Thanksgiving will be celebrated in less than two weeks, occurring just a month after many students at all levels have returned to in-person classes. The amount of indoor activity and inability to physically distance has risen dramatically recently. Unfortunately, case counts across Canada and around the world began rising in September.

The most recent example of the virus’ invasiveness is from the White House. On October 2nd at about 1 am Eastern President Trump and First Lady, Melania, announced that they had both tested positive for the coronavirus. White House aide, Hope Hicks, had also tested positive one day earlier. It is not clear how or when they were infected, or who else has been exposed at the highest levels of the U.S. government.

Election Day in the U.S. is only one month away, on November 3rd, and it is expected that the campaign will intensify greatly over the next month. However, Trump’s health will certainly affect his ability to attend campaign events, and it will be necessary for him to quarantine to protect members of the Executive, Judicial and Legislative branches from infection.

Since the Canadian economy is tightly linked to American interests, it is necessary to follow economic and political developments in the U.S. Uncertainty regarding the U.S. political situation was contributing to the market volatility before the Trumps tested positive. Their positive tests caused European markets to drop sharply immediately after the news was announced. Markets prefer predictability, to allow both good and bad news can be “priced in” to the value of securities. Several situations were already causing markets to react:

- the shape and speed of the economic recovery, especially unemployment, which stands at 7.9% for September. https://www.bls.gov/news.release/pdf/empsit.pdf

- the House of Representatives, Senate and White House have failed to provide a new round of relief to individuals and companies or a comprehensive stimulus package

- the predicted legal battles over election results, regardless of the margin of victory

- election related civil disobedience, which will be viewed alongside and as a continuation of the racially motivated protests and riots that occurred during the summer

The hope is that the heightened level of uncertainty (and volatility) will end with 2020, but we will first need to understand the effects of Trump’s illness.

In the short-term avoiding an election here seems to be in the best interests of most, but not necessarily all, Canadians. Avoiding the distractions of a campaign promotes focus on Covid-19 recovery. The latest details from the Canadian Federal government on stimulus are available at https://www.canada.ca/en/department-finance/economic-response-plan.html

IMPORTANT DISCLAIMERS

This material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please make sure to see a professional advisor for individual financial advice based on your personal circumstances.