What happened in October?

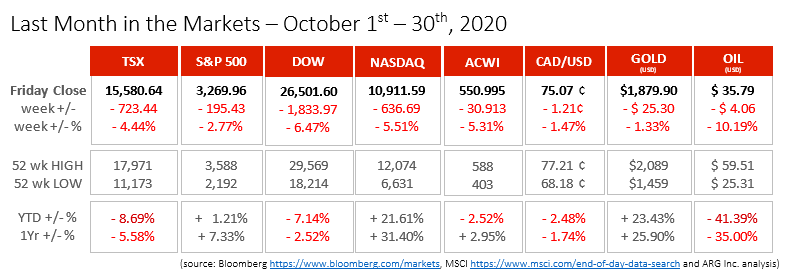

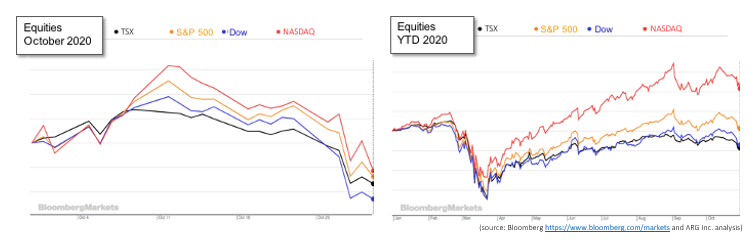

Last month was particularly unkind to North American equity investors. A minor peak before mid-month started a week-long slide in equity values. The five trading days ending October 30th was the worst week for the major indices in North America since March 20th. October’s second-half and overall drop was driven largely by the pandemic’s resurgence. After declining numbers of new cases through September, the U.S. reported higher new cases during the last week of October than the peaks of 74,000+ per day in July. Canadian cases began to rise earlier, at the start of September, and continued throughout October reviving the need for business and social restrictions across our country. covid source 1 covid source 2 covid source 3

In March, more than six months ago, we faced a great deal of unknowns regarding the virus, the disease and measures to treat it, as well as slow its spread. Governments around the world, and in Canada, are struggling with the appropriate balance of public health measures and economic recovery actions.

Seemingly a long time ago, sensational coronavirus news arrived at the beginning of October when President Trump contracted the coronavirus. The lack of credible information regarding his condition, fueled uncertainty in markets on October 2nd. After gains on Wednesday and Thursday of that week, Trump’s announcement in the early hours of Friday contributed to losses on the last day of that week when the NASDAQ dropped 2.2% of its value during a single trading session. Trump covid source

Negative U.S. employment news also intensified the drop on October 2nd. Only 661,000 American jobs were added during the month of September. This left 12.6 million Americans still unemployed and the unemployment rate at 7.9%. For comparison, in February before the pandemic, 6.8 million Americans were unemployed and the unemployment rate was just 4.4%, a historically low level. US employment source

Canada’s recovery has also slowed. Gross Domestic Product (GDP) grew 6.5% in June and only 3% in July. June’s strong rebound was slowed in July. Again, for comparison, July’s Canadian GDP was 5.8% below the output measured in February. July GDP source

On Tuesday, October 13th the International Monetary Fund (IMF) revised its prediction for global economic recovery, predicting 2020 economic activity as a 4.4% contraction compared with 2019. The IMF predicted that the Canadian economy will shrink 7.1% in 2020 and then grow 5.2% in 2021. The IMF placed our performance below global numbers and for other developed economies. IMF source

October 18th was Nancy Pelosi’s self-imposed deadline to agree on a new stimulus package to support Americans. As the Democrat’s House leader she and Steve Mnuchin, Secretary of Treasury negotiated past the deadline until the end of the week. No compromise was reached. Nancy Pelosi was portrayed as inflexible and the White House was viewed as focused on political games. Both positions were and continue to be unhelpful for struggling Americans, the economy and capital markets. Stimulus deal source

On an individual level, highly punitive taxes on the recently introduced Canada Recovery Benefit for self-employed individuals were enacted. It could provide a disincentive to taking on additional work. A conversation with your licensed tax practitioner is recommended to better understand this development for those working for themselves. CRB source

What’s ahead for November and beyond?

Canadian investors will face two major issues for the balance of the year and into 2021:

- The Canadian, North American and global progress against the coronavirus will be a guiding influence for markets, especially equities. Until economies return to production and employment levels that approach pre-Covid days, companies will have their revenue, earnings and, ultimately, share values trimmed. The triangle defined by the cities of Buffalo, Pensacola and Fargo is seeing the highest levels of new infections as the pandemic moves to less populated areas and smaller cities across the United States. In 2016 Donald Trump received high enough levels of support from these geographically large, yet sparsely populated areas to win electoral votes and the presidency while losing the popular vote. Covid source

- On November 3rd, the outcome of elections for Congressional Senators and Representatives, as well as for President, will determine the nature of any economic stimulus response and public health measures against the coronavirus. During the early days of November, and perhaps for weeks to follow, the results of the election may be unclear and contested. Uncertainty provides fuel for market volatility. election source

The next few weeks and months will likely be a bumpy ride, unless one side wins a landslide victory and the pandemic is controlled effectively and quickly.

Do not hesitate to contact our office if you have any questions or concerns.