What Happened in November?

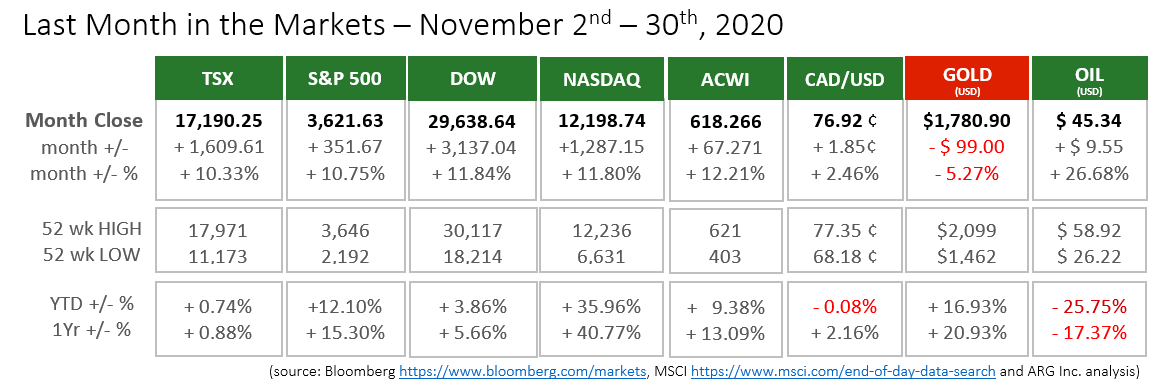

After two consecutive months of “all red” grids, markets returned to the performance displayed in August when increasing values dominated and gold was the only indicator that lost value.

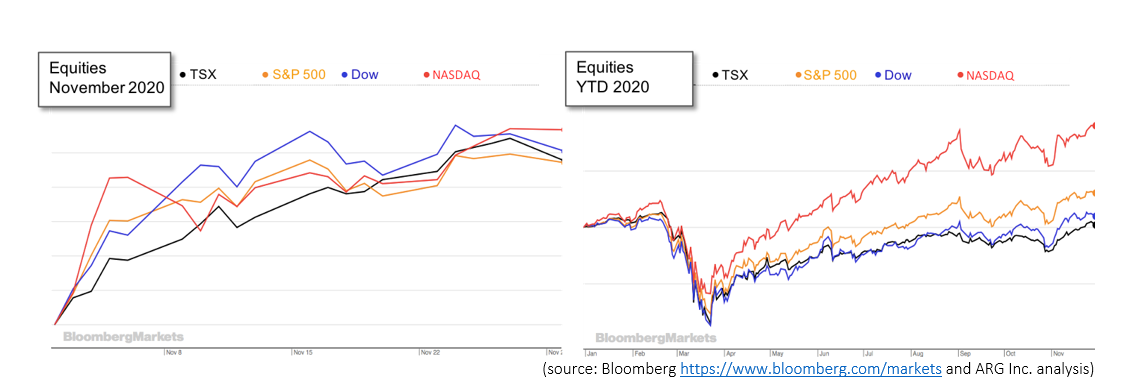

During November, North American and global equity indices surged ahead by 10 to 12 percent. Allowing the TSX to end the month with both its Year-to-Date and Year-over-Year back in positive territory, the first time it has been achieved since late February. The Dow bested the NASDAQ in monthly returns, which has not occurred since September 2019. This indicates a positive relativity for major U.S. corporates compared to technology stocks, especially when the Dow’s slight November “win” is held in context of the Dow and NASDAQ’s Year-to-Date performance of 3.86% and 35.96%, respectively.

This improving market performance for equities occurred during the backdrop of the U.S. elections of November 3rd and the advance of the pandemic.

- As predicted, the outcome of the presidential election was delayed. The result hinged on the counts and recounts in Wisconsin, Pennsylvania, Michigan, Arizona and Nevada.

- Also, as predicted, Donald Trump promoted his own legal challenges by questioning absentee, advance and mail-in voting procedures in several states. A sitting President, who is seeking re-election, contesting the results created fear for many that turmoil, political unrest and violence would result. Thankfully the unfounded allegations have been dismissed in courts across the U.S. and it appears that a peaceful, smooth and delayed transition has finally commenced. For markets, especially equities in the U.S., this turmoil followed by increasing calm, albeit slow to arrive and small in stature, has given markets a boost.

- Infections, hospitalizations and deaths continue to rise globally, particularly in the United States where daily rates are approaching and surpassing the peaks of late spring and summer.

- AstraZeneca provided positive vaccine development news to counter disease spread, adding to announcements by other vaccine makers. Earlier in the month Moderna announced that their coronavirus vaccine, which utilizes a similar RNA-based process as Pfizer, was equally effective at a 95% level of efficacy. The success of the first two companies who are using similar technologies lends credence to each other’s efficacy claims. The results from dozens of additional vaccine efforts have not been shared and their success could further support this early progress.

- Unfortunately, the vaccines are not available immediately. At this point in their development, both the Moderna and Pfizer solutions require extreme refrigeration and two separate doses to be safe and effective. The logistics surrounding the production, shipping, delivery, storage and administration of the vaccine is daunting. https://www.theglobeandmail.com/investing/markets/inside-the-market/market-news/article-premarket-global-stocks-head-for-record-high-on-recovery-vaccine/ https://www.nytimes.com/2020/11/18/health/pfizer-covid-vaccine.htmlhttps://www.theglobeandmail.com/investing/markets/inside-the-market/market-news/article-premarket-world-stocks-catch-breath-after-vaccine-euphoria/

- Canada is facing similarly dire pandemic statistics as the U.S. In addition to the public health measures, new federal financial support for individuals and commercial tenants has been announced. Click here to see the latest details of Canada’s Covid-19 Economic Response Plan: https://www.canada.ca/en/department-finance/economic-response-plan.html#industry

- Provincial governments and local health authorities are responding to pandemic failings with renewed restrictions which will slow, if not reverse economic progress that had been achieved, but will provide additional health protections. The latest details are compiled here: https://www.theglobeandmail.com/canada/article-coronavirus-rules-by-province-physical-distancing-open-closed/

- Measures have been renewed, and in some provinces and cities they have been strengthened. It is necessary to remain informed and current for your province, region and city, and in your destination for domestic travel. A summary of the latest measures can be found at: https://www.theglobeandmail.com/canada/article-coronavirus-rules-by-province-physical-distancing-open-closed/

What’s Ahead for December and Beyond?

On Monday, November 30th Finance Minister, Chrystia Freeland, provided an economic update. Additional stimulus of $70-100 Billion has been planned once the pandemic is under control and is expected to continue for the next three Federal fiscal years. Details will be released in the 2021 Federal Budget in late February or March. The projected budget deficit for this year has been updated to $381 Billion, $121 Billion for 2021/22 and $50 Billion for 2022/23. The stimulus package, when presented inside the next Federal budget, will make it a confidence vote, which could end the current Liberal minority government’s rule and cause a spring election. Video of the announcement from CBC is found at: https://www.cbc.ca/player/play/1825866819963

The public health success against Covid-19 domestically and internationally will continue to affect financial markets as we conclude 2020. In the next several weeks expect updates and confirmations to key tax filing dates, government payment amounts and RRIF withdrawals for 2021.