What happened in February?

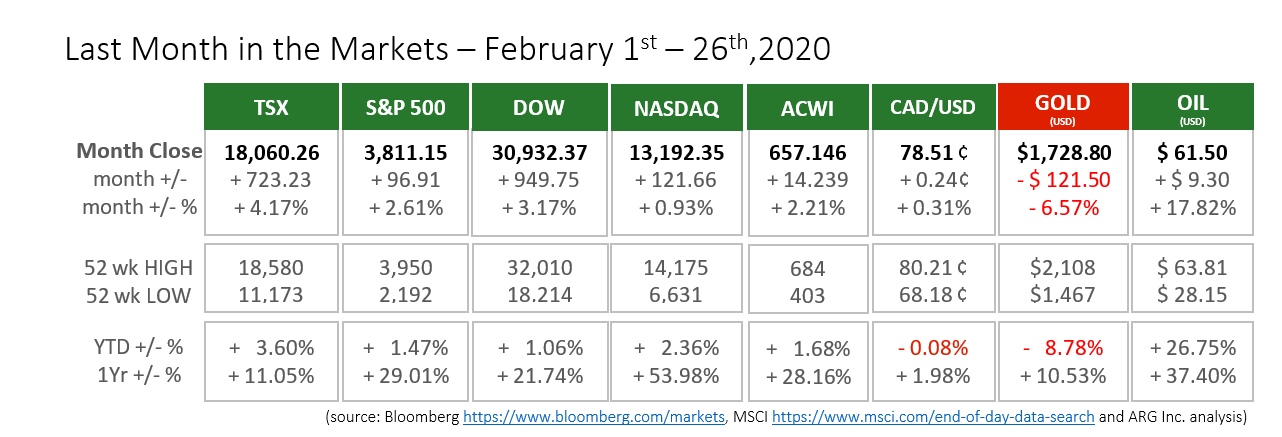

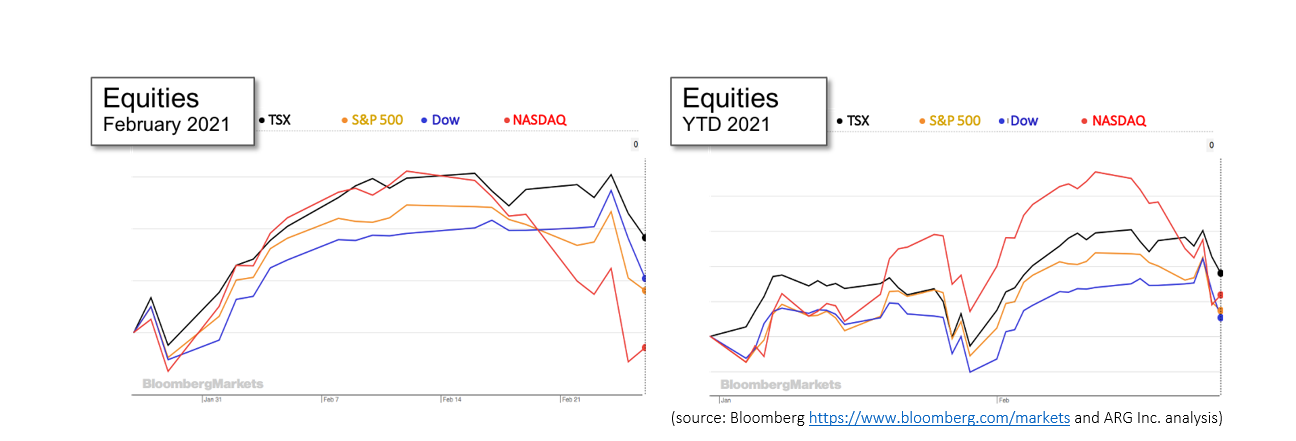

Once equities passed a late January decline, February’s very strong start powered monthly gains despite a decline at month’s end. It has been 12 months since the TSX delivered the highest returns and only the second time in 16 months that the NASDAQ was the poorest performing index.

February began with one of the best five-day trading sessions for equities. Equity indices rose about 5% and pulled Year-to-Date performance from negative back into positive territory. The rise was exceptionally broad as every sector in the TSX and S&P 500 made gains to contribute across the board.

Most of the first week’s success relied upon progress in Washington toward a stimulus package. The alignment of the House of Representative, the Senate and the Presidency to Democrat-control should make passing legislation easier.

As we moved into the second week of February strong equity performance continued along with a rise in the Canadian dollar, gold and oil. The TSX and the S&P 500 hit new record highs based in part on:

- Coronavirus infections, hospitalizations and deaths continued to improve globally

- Corporate earnings in Canada and the U.S. were generally better than expected

- U.S. lawmakers built additional momentum for the eventual enactment of stimulus measures

- Janet Yellen, Secretary of the Treasury and former Federal Reserve Chair, indicated that recovery could be swift if stimulus measures are bold enough

- The Federal Reserve indicated that it would continue to support recovery in the long term as U.S. inflation has not shown itself and consequently will not need to be trimmed with higher interest rates in the near future

The major news of the second week was the acquittal of Donald Trump at his second impeachment trial on February 13th just before 4 pm. 57 Senators voted “guilty” falling short of the two-thirds (67 votes) required for conviction.

North American equity indices began to falter just after the mid-month mark. After the TSX, S&P 500, Dow and NASDAQ reached new all-time highs on February 16th they all finished the week and the month lower. Gains had been caused by progress against the coronavirus as cases, hospitalizations, deaths and vaccine distribution news all improved. https://www.nytimes.com/2021/02/26/us/coronavirus-today.html

The positive effects of medical news on equity values were overcome as the spectre of inflation reappeared. Canada’s Consumer Price Index (CPI) had its largest monthly increase in about a year, which was driven by the prices of durable goods and gasoline. The U.S. Producer Price Index (PPI) rose at higher levels than recently seen. Both indices are moving closer to the long-standing target inflation rate of 2%. The Federal Reserve and Bank of Canada have indicated that they will begin raising interest rates once an average of 2% inflation is reached. The fear is that growth would need to be trimmed to control inflation before economic recovery is fully achieved. Rates are at their bottom of their effective range, and since they cannot be lowered, eventually they will rise. The reaction in equity markets seems to account for a long-term outlook, and interest rate increases are not expected in the near term

https://www150.statcan.gc.ca/n1/daily-quotidien/210217/dq210217a-eng.htm https://www.bls.gov/ppi/#news

https://www.edwardjones.com/us-en/market-news-insights/stock-market-news/markets-week

February concluded with another trying week for North American equity investors. The major indices fell by 2% and the NASDAQ doubled that decline at 4%. The Canadian dollar lost another percentage point to its American counterpart.

The results by the large Canadian banks provided support for the TSX and its most heavily weighted sector, Financials. Lower loan-loss provisions, lower credit default rates, increased revenues were the reasons the banks were able to exceed analyst earnings expectations. The institutions were able to best their own expectations and are admittedly further ahead on recovery that they expected. Collectively, they earned $13.9 Billion in the quarter ending on January 31st. Thankfully, nearly every Canadian investor holds bank stock directly or within mutual funds or ETFs. https://www.theglobeandmail.com/business/article-big-six-banks-beat-own-predictions-climbing-above-prepandemic-levels/

In news that does affect every Canadian household, Mark Machin, Chair of the Canada Pension Plan Investment Board (CPPIB), resigned last week amid controversy surrounding his international travel during the pandemic. He is currently in Dubai where he has received the coronavirus vaccine. This is the latest example that a leader’s judgment and integrity is demonstrated more broadly than merely with at-work decisions. The Board of Directors felt that the leader of a nearly $500 Billion public investment fund should be available for in-person conversations, meetings and decisions during a period of market volatility. John Graham, the former head of credit investing at the CPPIB, will now lead the organization. https://www.theglobeandmail.com/business/article-head-of-canadas-largest-pension-fund-steps-down-in-the-wake-of-covid/

What is ahead for March and beyond?

The vaccine will become more widely available across Canada beginning in March as shipments increase. In general, members of the next highest priority groups (beyond vulnerable seniors in congregate settings and their caregivers) will become eligible to receive the vaccine. Check the provincial health ministry and local health unit websites to understand the anticipated sequencing for you and your family members.

Unfortunately, another wave of infection has been predicted for spring in Canada and the U.S. The hope is that the arrival of more vaccines and renewed safety measures will blunt its effects. Health Canada has approved the AstraZeneca vaccine and we will begin receiving 20 million doses almost immediately. In the U.S. the Johnson & Johnson single dose vaccine began shipping on March 1st. 100 million doses will be available to Americans by June. https://www.nytimes.com/2021/02/25/health/coronavirus-united-states.html https://www.nytimes.com/2021/02/26/world/canada-astrazeneca-vaccine.html

A major component of the economy is consumer spending. It is returning faster than many have expected could increase further as new U.S. stimulus appears. The Democrat controlled government is focusing benefits to lower income individuals and small businesses. These two groups are more likely to spend stimulus cheques, which will add more momentum to economic recovery. https://www.nytimes.com/2021/02/26/business/economy/personal-income-spending.html

For Canadians the most current benefits from our federal government can be found at https://www.canada.ca/en/department-finance/economic-response-plan.html