Last Month in the Markets – May 3rd – 31st, 2021

What happened in May?

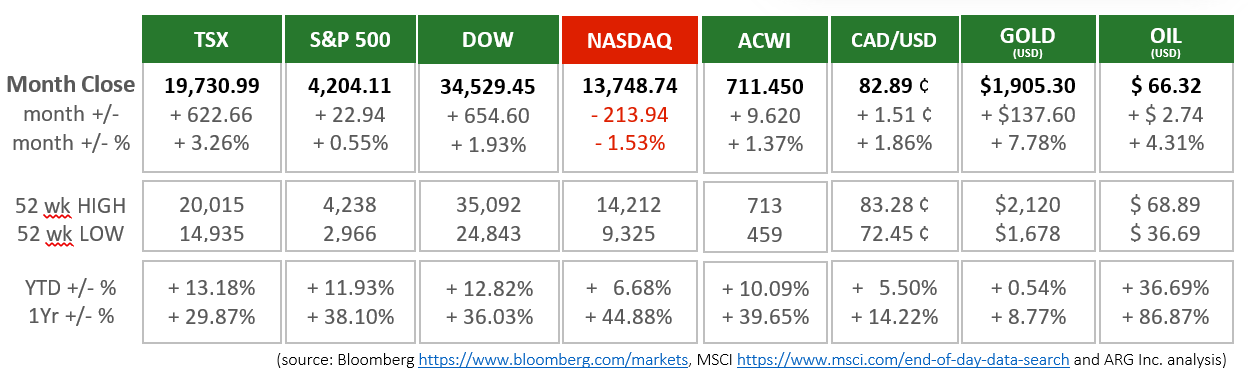

Last month was a particularly strong month of Canadian equities as the TSX rose by 3¼%, besting the major U.S. indices and MSCI’s All Country World Index (ACWI). The TSX had been even higher, but lost a little ground on May 31st when U.S. markets were closed for Memorial Day.

Each of the North American equity indices experienced their lowest points for the month after one-third of May had passed. The TSX fell less on May 10/11 and then delivered consistent gains for the rest of the month to out-distance its American rivals. After the first five months of 2021 the TSX leads the S&P 500, Dow and NASDAQ in Year-to-Date performance as well.

The Canadian dollar has risen 5.5% in 2021 which provides an additional boost to domestic investments compared to U.S. dollar holdings.

The first week of May ended with pessimistic and disappointing employment news. Renewed pandemic restrictions for Canadians were implemented in April and led to 207,000 job loses, about 35% more than expected. The Canadian unemployment rate announced at the beginning of May was 8.1%. In the U.S. 266,000 new jobs were added when almost 1 million additional jobs were expected. Instead of increasing the number of new jobs from March’s result of 770,000, employment growth fell by about 200,000 jobs. About 7 million less jobs exist in the U.S. than before the pandemic began, and the unemployment rate is 6.1%.

About two-thirds of North American Gross Domestic Product (GDP) is comprised of consumer spending. The purchase of products and services by individuals and families is the largest contributor to GDP. Consumers without income (i.e. jobs) will exhaust their savings and stall economic recovery. Monitoring job data domestically and internationally is critical to understanding progress against the pandemic.

The dip in equity markets attributed to jobs data was enhanced by the announcement of U.S. inflation figures for April. U.S. inflation is higher than expected at an annualized rate of 4.2% over one year ago and 0.8% more than the last reported month (March). The monthly core inflation rate, which excludes food and energy, rose 0.9%. This is the largest one-month inflation increase in 40 years, which was 1981.

Many American states reduced restrictions simultaneously causing a surge in domestic demand, leading prices higher as supply lagged. Wage growth could support further price increases once short-term stimulus savings are spent. Currently, wage growth is not positioned to fuel additional price increases. The Federal Reserve and other central banks closely monitor inflation to determine if monetary action is needed. The primary method to slow inflation is an increase to interest rates.

Higher interest rates directly increase the cost of borrowing, which raises the cost of living of consumers and for business expansion, which would slow Gross Domestic Product (GDP) growth. Central bankers would rather choose to control interest rates than have inflation control the economy. It is much more complicated than that, but inflation and high (or higher) interest rates are typically bad for most people and investors. The lone exception would be those who rely solely on interest income.

During the last full week of May the TSX was led by the Financial sector as the major Canadian banks released positive earnings reports. The Bank of Montreal, CIBC, Royal Bank and TD announced results that exceeded expectations for the latest quarter. Most of the increased performance has been attributed to declining loan losses and the accompanying reserves necessary to cover unpaid debt. The default rate on outstanding credit is a strong indicator of the health of the overall economy.

American firms have also delivered impressive quarterly earnings. According to FactSet and Standard&Poors analytics 86% of U.S. public companies have beaten analyst profit projections, and the expected profits are more than 20% than anticipated.

In the short term the alignment of corporate profits and equity prices should provide some predictability for investors. Early emergence from the pandemic had the promise of recovery driving stock prices, it appears that much of that promise is being delivered and markets are continuing to react positively.

What’s ahead for June and beyond?

GDP growth based on a broad reopening of the economy will drive capital markets. The major contributor to safely reopening is the administration of vaccines.

As June begins 58% of Canadians have received at least one dose of vaccine, which ranks Canada as 7th worldwide. Four of the six countries ahead of us have very small populations, 500,000 or less, and small geographies. Unfortunately, less than 6% of Canadians have been fully vaccinated. Our reopening will depend on increasing the rate of vaccination and full vaccinations over the summer.