What happened in January?

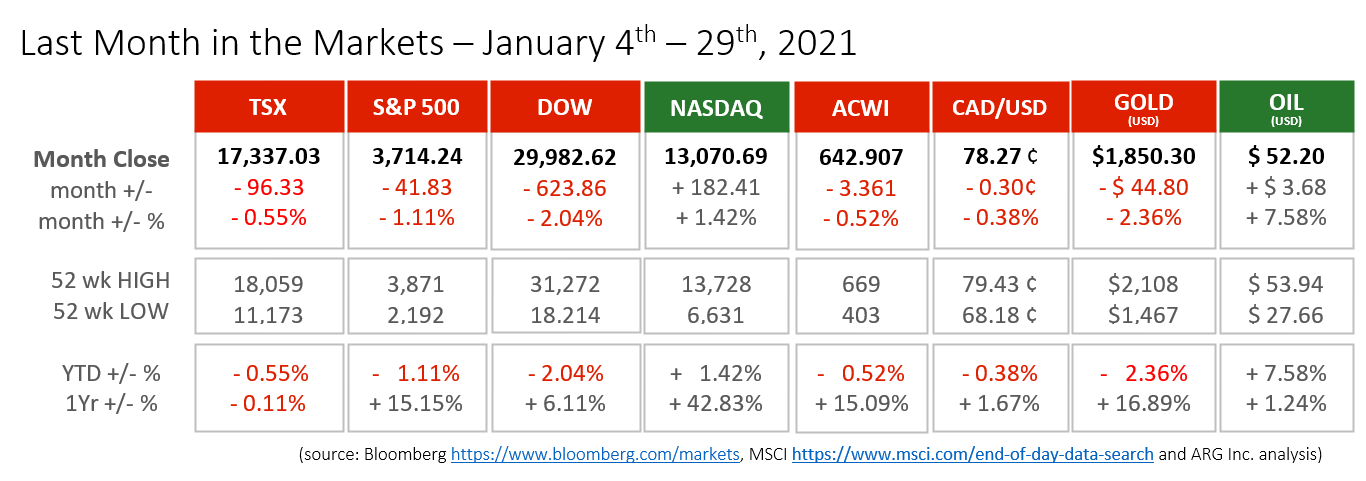

By the end of January, the first month of 2021 had delivered disappointing results almost universally. The major North American equity indices and the MSCI All-Country World Index (ACWI) all lost value with the exception of the tech-heavy NASDAQ.

Generally, the physical distancing, store closures, online ordering and working from home have created more reliance on computer hardware and software for companies that well represented in the NASDAQ. As a result, this index continued to rise. Several large firms within the NASDAQ, like Apple, Microsoft and Google’s parent, Alphabet, reached all-time highs during the month.

For most other types of enterprises the path of the pandemic and its effect on business activity has been uneven and unpredictable. The physical distancing measures, alone, have made it more difficult for labour, customers and goods and services to move freely. Consequently, many sectors have suffered.

The equity results are mixed since they rely on economic indicators that have delivered positive and negative news over the last month and since the pandemic began:

- Public health measures against the coronavirus have not significantly reduced the spread of the disease or the ability to contain it. Several issues regarding the approval, manufacture, distribution and administering of vaccines have lessened its effectiveness.

- Economic relief for individuals, families and businesses has stalled as political machinations continue in Washington.

- On January 20th the Bank of Canada held its benchmark interest rates unchanged. Not raising rates could be viewed as positive, but the underlying reasons are negative. Rates are not being raised because economic recovery remains elusive. One week later the U.S. Federal Reserve announced their interest rate decision, holding the federal funds rate steady in the range of 0 to ¼%. This inaction has been promised until inflation rises to an average of 2%. Inflation at the average of 2% will require the rate to exceed this level greatly or for a lengthy time period. The Fed and Bank of Canada both view heightened inflation as proof that sustainable, economic expansion has occurred. Once expansion is confirmed the Fed may take action to trim growth with higher interest rates. https://www.bankofcanada.ca/2021/01/fad-press-release-2021-01-20/ https://www.federalreserve.gov/newsevents/pressreleases/monetary20210127a.htm

- In its quarterly “Business Outlook Survey” released mid-month, the Bank of Canada indicated that businesses were poised to move positively forward prior to the latest round of lockdowns. More than half of firms expected revenue, staff and investments to increase this year. Surveys were conducted during the second half of November and into early December prior to the latest round of lockdowns. Similar sentiments are held in the U.S. where many businesses expect late 2021 and 2022 to be the timing of a resurgence of economic activity that must wait for the vaccine to be administered widely. Surviving the winter and into the summer is the most pressing priority for many businesses, especially after news that the stores of vaccine earmarked for second doses are unavailable as the Trump administration concludes. Firms on both sides of the border are less optimistic than they have been and have been moving the timing of economic recovery further into the future.https://www.theglobeandmail.com/business/economy/article-boc-says-business-hiring-investment-outlook-was-improving-heading-into/ https://www.bankofcanada.ca/2021/01/business-outlook-survey-winter-2020-21/ https://www.nytimes.com/2021/01/11/business/economy/coronavirus-business-outlook.html

- Canadian jobs data show employment fell by 63,000 in December, the first decline since April. Unemployment remained almost unchanged since November at 8.6%. Also reflecting lowering expectations, the number of people seeking work, Labour Force Participation, fell for the second consecutive month. https://www150.statcan.gc.ca/n1/daily-quotidien/210108/dq210108a-eng.htm

- January concluded with a rebellion by retail investors banding together to manipulate the value of a limited number of shares. Specifically, GameStop and AMC were targeted and their prices were bid-up to staggering levels in just a few days. Some normalcy returned for equities when the agitators focused on silver.

What’s ahead for February and beyond?

The long-term health and success of investing will rely on the economic recovery once the pandemic has subsided. As the rollout of the vaccine continues to suffer logistical issues the return to normal, or even the new normal, seems to be pushed further into the future.

The capital markets are merely reflecting the sentiment held within society regarding the battle against the coronavirus. For some time it has been very optimistic but requiring great patience. This perspective and requirement are not anticipated to change for a significant amount of time.

To assist us the most recent response for individuals, businesses and sectors from the Canadian federal government can be found at https://www.canada.ca/en/department-finance/economic-response-plan.html

What Investors Should Watch for in 2021

After the bumpy ride that was 2020, investors are eager to know what they can expect in the coming year. While there is no way to know for certain what 2021 will bring, there are a few key events that are expected this year that could impact the markets and investors.

What You Need to Know

The Biden Presidency

Joe Biden’s inauguration as the 46th president of the United States is to take place in the coming weeks. Markets historically react to a change in the presidency and it is likely this time will be no different. The Biden administration will introduce new policy that can be expected to have an impact on the US economy and markets.

Vaccine Rollout

Vaccine rollout has already begun in Canada and in many countries around the world. The Covid-19 has given many hopes that the pandemic may come under control in the coming year. The vaccine could give people the option to return to work, start eating at restaurants and shopping at retail locations again… to name a few. These would all be boosts for the economy. As we see economies start to reopen throughout the year, it is likely that the market will respond positively.

Travel Resuming

Connected to the vaccine rollout and economic reopening, it is expected that the travel industry will also see a positive upturn. Tourism resuming would give a boost to tourism linked sectors including airlines, hotel chains, and restaurants… to name a few.

The Bottom Line

2021 is will have investors watching closely as the pandemic rages on. While the vaccine offers hope, rising case numbers and political tensions in the states could slow the positive effects. 2021 will bring surprising news and hurdles just as previous years have. It is more important than ever not to overreact to the news and work with your financial advisor to prepare for the unexpected.