A Big Surprise from Car Makers:

Guess what? One of the biggest car companies in North America has started doing something really strange with their prices, and it's causing quite a stir. They're asking young people, like those who are 25 years old, to pay a jaw-dropping $383,579 for a car! But here's the kicker: if you're 60, the same car only costs $42,076. Sounds pretty unfair, right? It's got a lot of people wondering what's going on and if it's even okay to do that.

What's Really Going On?

This whole thing has sparked a lot of talks. Some folks are pretty upset, saying it's not fair to make young people pay so much more. They think the car company is taking advantage of younger folks who might not know a lot about money yet. It's like the big company is targeting them because they dream big and want nice things.

But, before we get all worked up, let's take a closer look. The big difference in prices isn't just the car company trying to be mean to young people. It's actually a way to show us something important about money – something called "opportunity cost" and how saving your money can really add up over time thanks to something awesome called "compound interest."

Understanding the Big Picture:

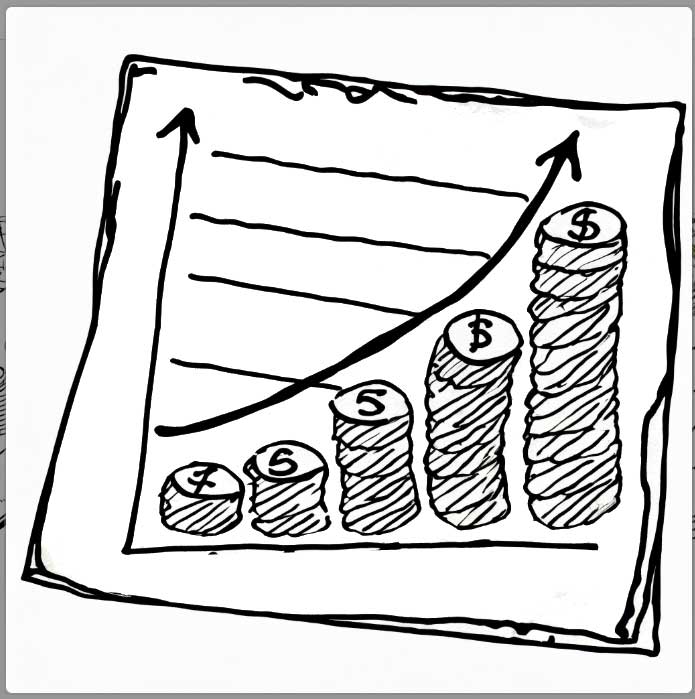

Here's the deal: when they talk about the car costing $383,579 for someone who's 25, they don't mean you write a check for that amount right away. They mean if you took the money you'd spend on a super fancy new car and invested it instead, in 35 years, it could grow to be that much! For someone who's 60, they have less time for their money to grow, so the number is smaller, like $42,076.

This is a big eye-opener about how we spend our money. Every dollar we use today could turn into a lot more in the future if we're smart and put it into investments. It's like a magic trick with money, but it's all real!

Getting Smart with Car Money:

Let's talk numbers for a second. Imagine you're eyeing a brand-new car that costs $30,000. If you decide to get this car and pay it off over 7 years, your monthly payment would be around $438, considering a 6% interest rate.

Now, picture this: instead of that pricey new car, you decide for THIS TIME ONLY you will get a used car (we'll call it cosmetically challenged but reliable) for just $5,347. That's roughly what you'd pay in the first year for the new car. With the used car, you're not tied to those big monthly payments anymore.

So, what if you took that $438 you were going to spend on the new car every month and invested it in a moderate investment that grows by 7% each year? But here's the twist: you do this for just 6 years because the first year's money went into buying your used car.

After those 6 years, you stop adding money to the savings but let it sit and grow until you hit 65. After that six years, you can go buy a new car or rinse in repeat to see an even bigger number in retirement.

The Big Picture:

By choosing the used car and investing the money you would have spent on the new car, you're setting yourself up for a big win. By the time you're 65, that money could grow to a whopping $383,579, all from just one smart choice early on.

This isn't about missing out on nice things now; it's about seeing the bigger opportunity. If you keep choosing wisely, like going for the used car and investing what you save, you're building a strong financial future. It's about making your money work for you, turning one smart decision today into a big reward tomorrow.

The Takeaway:

So, this whole story about car prices is really a clever way to teach us something important. It's not just about how much we pay for something now, but also about what we could be missing out on in the future. It's a heads-up to think about how we use our money, especially when we're young and have a lot of time ahead of us to make that money grow.