What happened in 2021?

The last year, just like the past 22 months since March 2020, have been filled with investment uncertainty based on many major and minor factors. Thankfully early losses have been recouped and exceeded in nearly every case. Volatility has also tempered. The most recently concluded calendar year continued to reflect those themes of growth and calm despite turmoil in nearly every other aspect of daily life.

The world’s economy has been subjected to tremendous negative and positive forces as the pandemic continues. As case counts, hospitalizations and deaths wax and wane the response from local, regional, and national governments was adjusted and Gross Domestic Product (GDP) was reduced by commercial and travel restrictions. Labour and supply chain shortages, while monetary policy, direct supports and global cooperation, at times, sought to lessen or prevent negative economic shocks.

For most of last year, the largest effect of the pandemic and the efforts to control it have been centered on regaining job losses, overcoming growing and persistent inflation, providing appropriate direct assistance to individuals, families and businesses while fighting the spread of the coronavirus and two major variants-of-concern; Delta and Omicron.

Analyzing pandemic effects on the economy and investments might be a more satisfying activity than a painful recap of local and global public health.

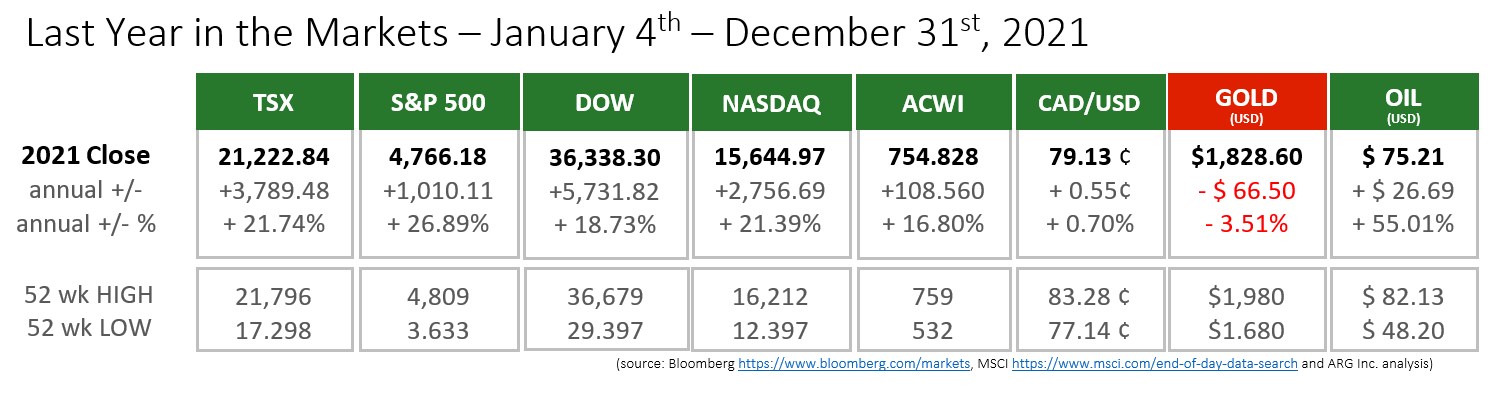

The TSX ended 2021 at 3,700 points and 22% ahead of its 2020 year-end level. Although the TSX reached its 52-week high in mid-November its level of 21,223 is the highest month-end and year-end in its history. Since 2000, last year was the third-best year for the TSX, bested only by 2003 and 2009. Three-quarters of the gain at the TSX came from its two largest sectors, Financials and Energy. Of the top ten performing stocks in Toronto, eight were from the Energy Sector. Healthcare, which includes cannabis companies, was the lone sector to decline. In addition to the impressive gains, 2021 experienced the second-smallest intra-year drop over this same period. That is, 2021 made tremendous gains aided by the lack of a significant pullback. https://www.bloomberg.com/news/articles/2021-12-31/s-p-tsx-index-falls-0-3-shopify-leads-decline-kxuw3tre

The S&P 500 rose more than 1,000 points and 27%, the Dow rose 5,700 (19%) and the NASDAQ delivered a 2,700-point (21%) increase. It was an excellent year for investors focused on North American equities as all eleven sectors of the S&P 500 rose by more than 13% for the first time ever. Energy and Real Estate led the way by returning more than 40% increases, while the Information Technology sector delivered 34% and edged out Financials for a third place within the index.

The All-Country World Index (ACWI) that is comprised of 2,966 large and mid-cap companies from 23 Developed and 25 Emerging Markets that represent 85% of the global investable equity opportunity set also made significant total gains in 2021. The ACWI was the laggard in our grid, above, primarily because its Emerging Markets component fell 2½% over the year, and still delivered 17% returns. Progress against the pandemic through vaccine administration lags in developing and emerging countries, and their capital markets have not strengthened as quickly as mature markets and economies. https://www.msci.com/documents/10199/a71b65b5-d0ea-4b5c-a709-24b1213bc3c5

Based on recent, negative pandemic news, and the events of the past year, one might feel that success against the virus and investment gains are directly and proportionally tied to one another. This is clearly not true for most equity investors who are focused on retirement savings with holdings that mirror the broad indices and are concentrated in North America.

Equity Index | 2019 Gain (Loss) | 2020 Gain (Loss) | 2021 Gain (Loss) | 3-year Gain (Loss) |

|---|---|---|---|---|

TSX | 19.05% | 2.17% | 21.74% | 42.96% |

S&P 500 | 28.88% | 16.26% | 26.89% | 72.03% |

Dow | 22.34% | 7.25% | 18.73% | 48.31% |

NASDAQ | 35.23% | 43.64% | 21.39% | 100.26% |

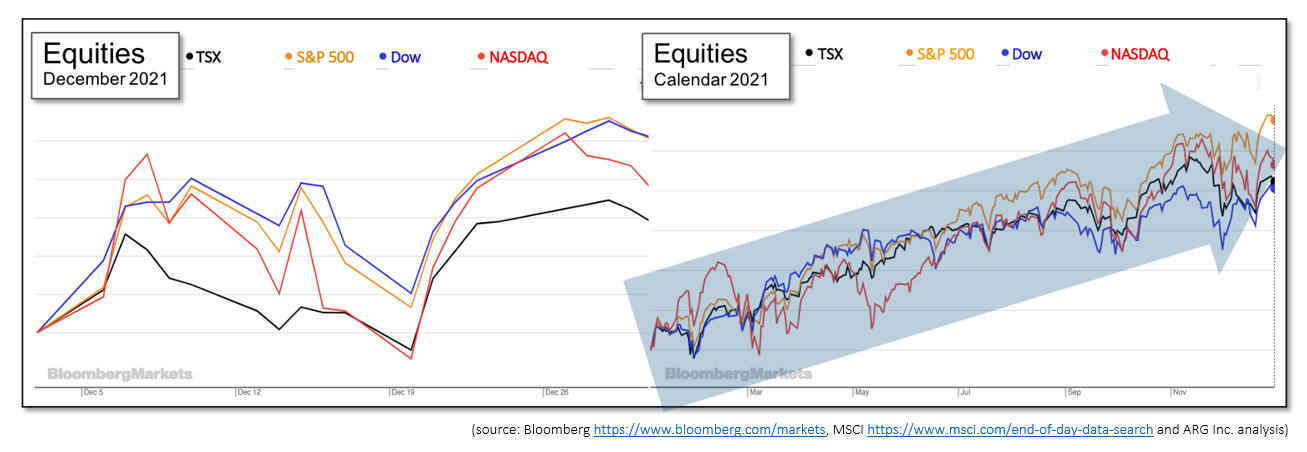

Notwithstanding the tragic events of the last twenty-two months, investors have seen the equity indices rise at historically high rates over the past three calendar years, with the NASDAQ as the clear leader over this period after doubling its value. Despite some increased choppiness at the end of 2021 (and into 2022), the year-long graph lines show a typical “saw tooth” upward progression over the last 12 months.

The price of oil and gold has risen about 63% and 43%, respectively over the same three-year period. The rapid rise in the price of oil during economic recovery has allowed the Canadian dollar to gain ground against its U.S. counterpart and finish 2021 ½ cent above where it started the year.What’s ahead for January and beyond?

The influences for investors in 2022 are virtually unchanged from 2021. Public health progress against the pandemic and the effects of the monetary policy response (along with various government’s fiscal actions) will determine market performance until Covid-19 becomes endemic.

As economic recovery continues, it is expected that employment and wage growth will maintain their trajectories, supply chain issues will linger, and inflation will remain above desired levels. This will cause central banks to respond with increases to short-term interest rates.

Rising interest rates will trim inflation by reducing economic growth, slower economic growth will deliver fewer and smaller opportunities for firms to drive revenue and profits, and the prospects of lower corporate performance will likely trim the growth of their share prices. Relative to 2021, the broad-based growth across nearly all sectors will become more selective and exclusive.

The latest release of the U.S. Federal Open Market Committee meeting minutes from the Federal Reserve shows that inflation concerns are growing. The Governors believe that inflation is not permanent, but it will continue longer than originally anticipated. The Federal Reserve is expected to continue the tapering of its bond buying program. It is likely to conclude near the end of next year’s first quarter. This will coincide with the newly anticipated increases to short term rates in mid-2022.

The Bank of Canada will announce its own measures to combat inflation and raise employment just prior to the next American announcement. Canada’s central bank has also indicated that it intends to raise rates sooner than originally forecast in response to inflation concerns.

It is difficult for any endeavour or team to repeat a strong performance for two consecutive years, or seasons. As its history has shown the equity market is not immune from this challenge. The S&P 500, for example, typically follows a year with performance like it achieved in 2021 with more muted performance. Historically, after a high-performance year, a drop of 12% occurs during the following year. This drop is a major contributor to preventing a repeat performance. This is not dissimilar to last year’s championship team losing games it should have won, still make the playoffs, but lose in the semi-finals.

Despite this history in equity investing, the fundamentals and supports remain in place to deliver more positive results. Although interest rates are expected to rise, they remain at historically low levels. Should a drop occur, it may be an opportunity to purchase or to rebalance positions.

Based on personal, professional, and financial factors, it may be time to examine additional investment and financial planning opportunities that will arise as monetary policy changes are enacted. The broad investment themes will be tailored to your unique situation to develop your plan.