Brant Financial Group – August 2025 Market Insight

Source: Statistics Canada

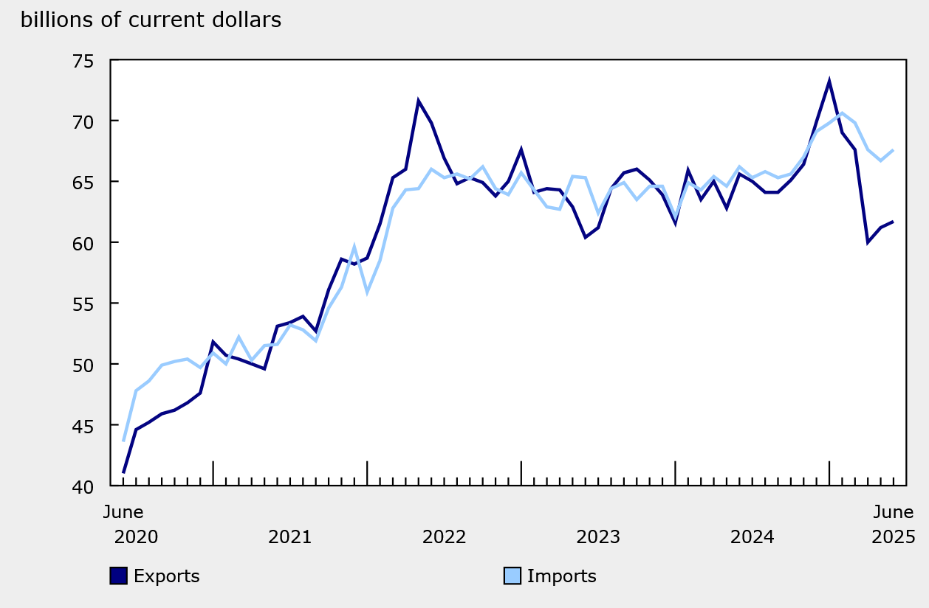

Canada’s merchandise trade deficit expanded to $5.9 billion in June, up from $5.5 billion in May, according to Statistics Canada. The increase was driven in part by a one-time, high-value import of industrial machinery tied to an offshore oil project. Without that shipment, imports would have declined.

On the export side, while overall export values rose 0.9%, volumes actually dropped 0.4%, highlighting underlying weakness in key sectors. Exports of passenger vehicles declined for the third consecutive month, and shipments of unwrought aluminum and steel also fell. These declines coincide with new U.S. tariffs on Canadian metals and continued slowdowns in North American automotive production.

Source: Statistics Canada

Canada’s trade surplus with the United States rose slightly to $3.9 billion, yet exports to the U.S. were still 12.5% lower than a year ago, reflecting the ongoing impact of tariffs and softer demand for Canadian-made goods.

Exports to countries outside the U.S. also dropped, down 4.1%, with lower shipments reported to both the UK and Japan. Overall, second-quarter data showed total exports fell nearly 13% from Q1, marking the sharpest quarterly decline since the post-pandemic recovery began.

The downturn comes amid escalating trade tensions between Canada and the U.S., with a new round of American tariffs taking effect August 1. While Ottawa has expressed disappointment, further negotiations are reportedly underway.

“Trade weakness and broader trade uncertainty show no signs of abating—not least due to Canada and the U.S.’s inability to strike a new trade deal last week,” said Marc Ercolao, economist at TD, in a research note. He added that steel, aluminum, autos, and energy are the sectors most affected.

What This Means for Investors

At Brant Financial Group (Assante Capital Management Ltd.), we believe short-term economic turbulence—especially when driven by political developments—should not drive long-term investment decisions. Trade policy and macroeconomic data matter, but thoughtful diversification, risk management, and goal-based planning matter more.

If you’re concerned about how trade issues or market volatility might impact your financial plan, we’re here to help you stay focused on what you can control—and prepared for what you can’t.