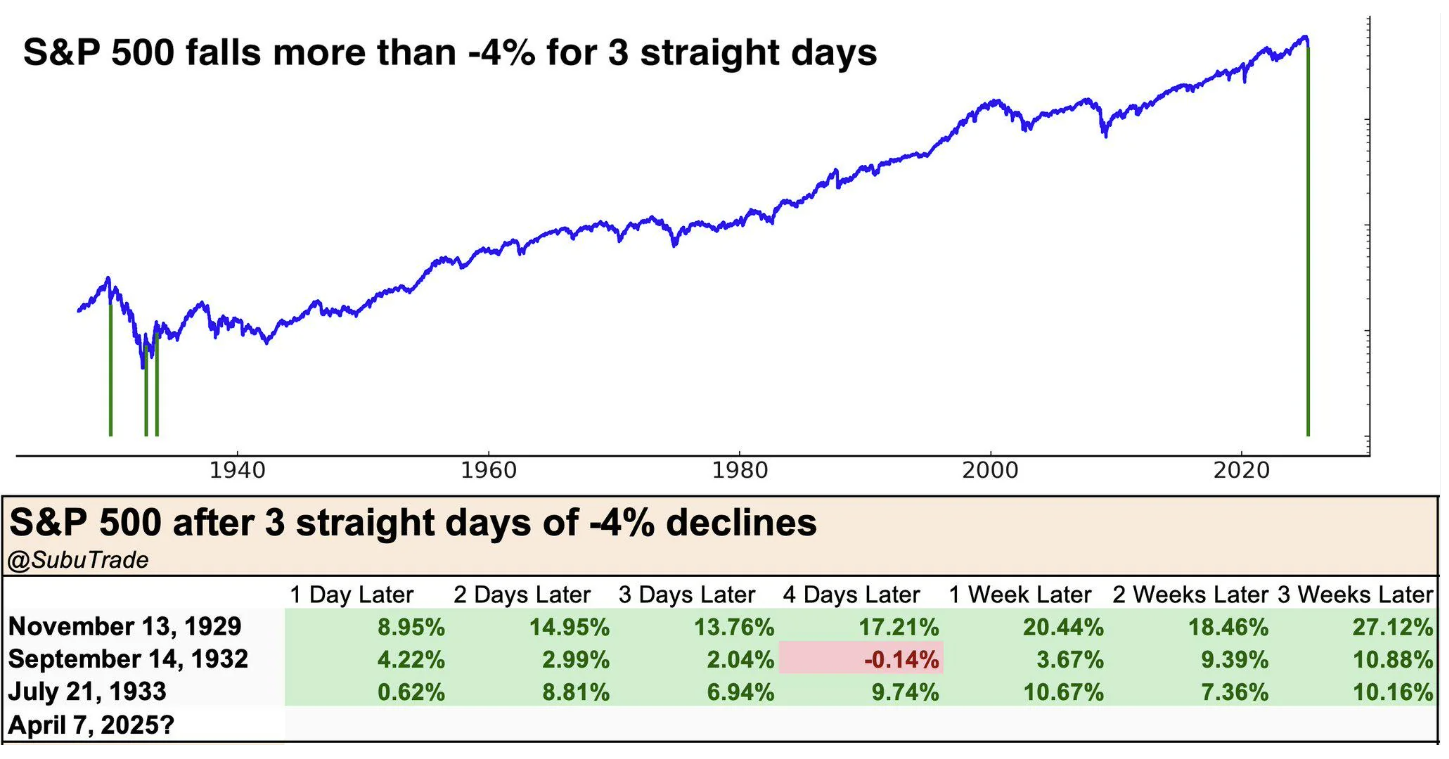

If you've been following the markets recently, you may have seen headlines about sharp declines in the S&P 500. It’s true—on April 7, 2025, the index experienced its third straight day of losses greater than 4%. While this kind of volatility can be unsettling, history tells us it’s not a reason to panic.

The chart above offers valuable perspective. It highlights the only other times in history the S&P 500 fell more than 4% for three consecutive days—during the depths of the Great Depression in 1929, 1932, and 1933. What happened next might surprise you.

The Bounce After the Drop

In each of those historic moments, the S&P 500 rebounded sharply in the days and weeks that followed. For instance:

- After the 1929 plunge, the index rose over 27% within three weeks.

- In 1933, markets gained nearly 10% just one week after the third day of losses.

- Even after the dip in April 2025, the S&P 500 climbed over 10% in the following three weeks (Yahoo Finance – S&P 500 Historical Data).

While each situation is different and past performance doesn't guarantee future results, one lesson is clear: markets can recover just as quickly as they decline (Morningstar – Why Staying Invested Matters).

The Bigger Picture

When you look at the full chart of the S&P 500 over the past century, a pattern emerges. The long-term trajectory is up, even though there are dips, bumps, and sharp drops along the way. These short-term fluctuations may feel dramatic in the moment, but over time, they become small blips on a steadily rising curve (Fidelity – The Ups and Downs of Market Volatility).

This visual reinforces one of the core principles of investing: time smooths the line. A well-built portfolio is not designed for just the next week or month—it’s designed for the long run. Diversification, strategic asset allocation, and a focus on your individual goals help ensure your investments are resilient, even in the face of temporary turbulence (Vanguard – The Case for Long-Term Investing).

What Should You Do Now?

If you're feeling uneasy about recent market moves, here are three things to keep in mind:

- Volatility is Normal: Markets never move in a straight line. Periods of uncertainty are part of the journey.

- Stay Invested: Trying to time the market often leads to missing the rebound. Discipline pays off over time (Schwab – Market Timing vs. Staying the Course).

- Check In, Don’t Check Out: This can be a good time to review your financial plan—but not to abandon it. If your goals haven’t changed, your plan likely doesn’t need to either.

At Assante Capital Management Ltd. Brant Financial Group, we’re here to help you navigate through all market conditions—good, bad, and everything in between. If you have questions or just want to talk through your strategy, we’re just a phone call away.

Let time work for you. Stay the course.