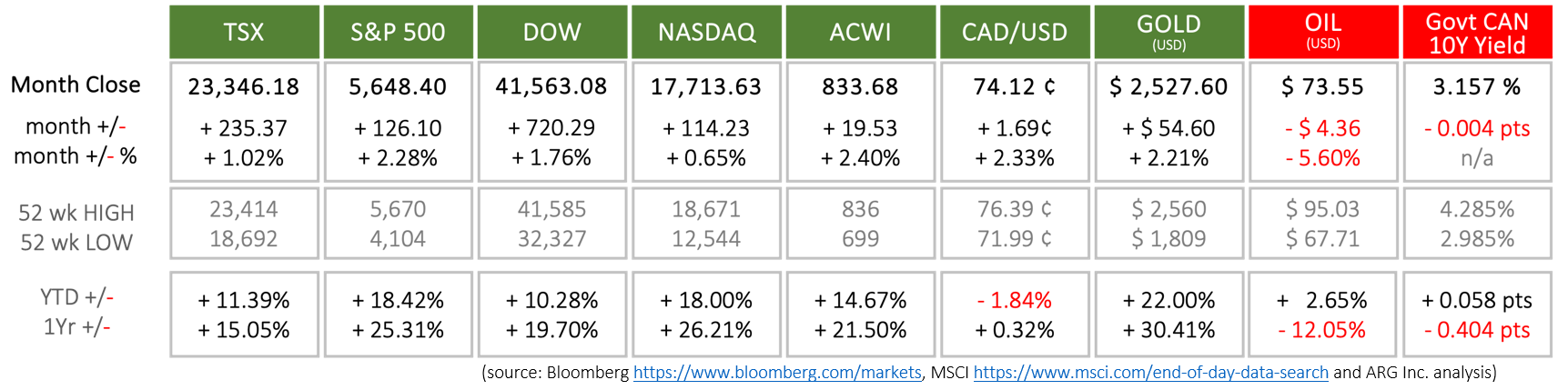

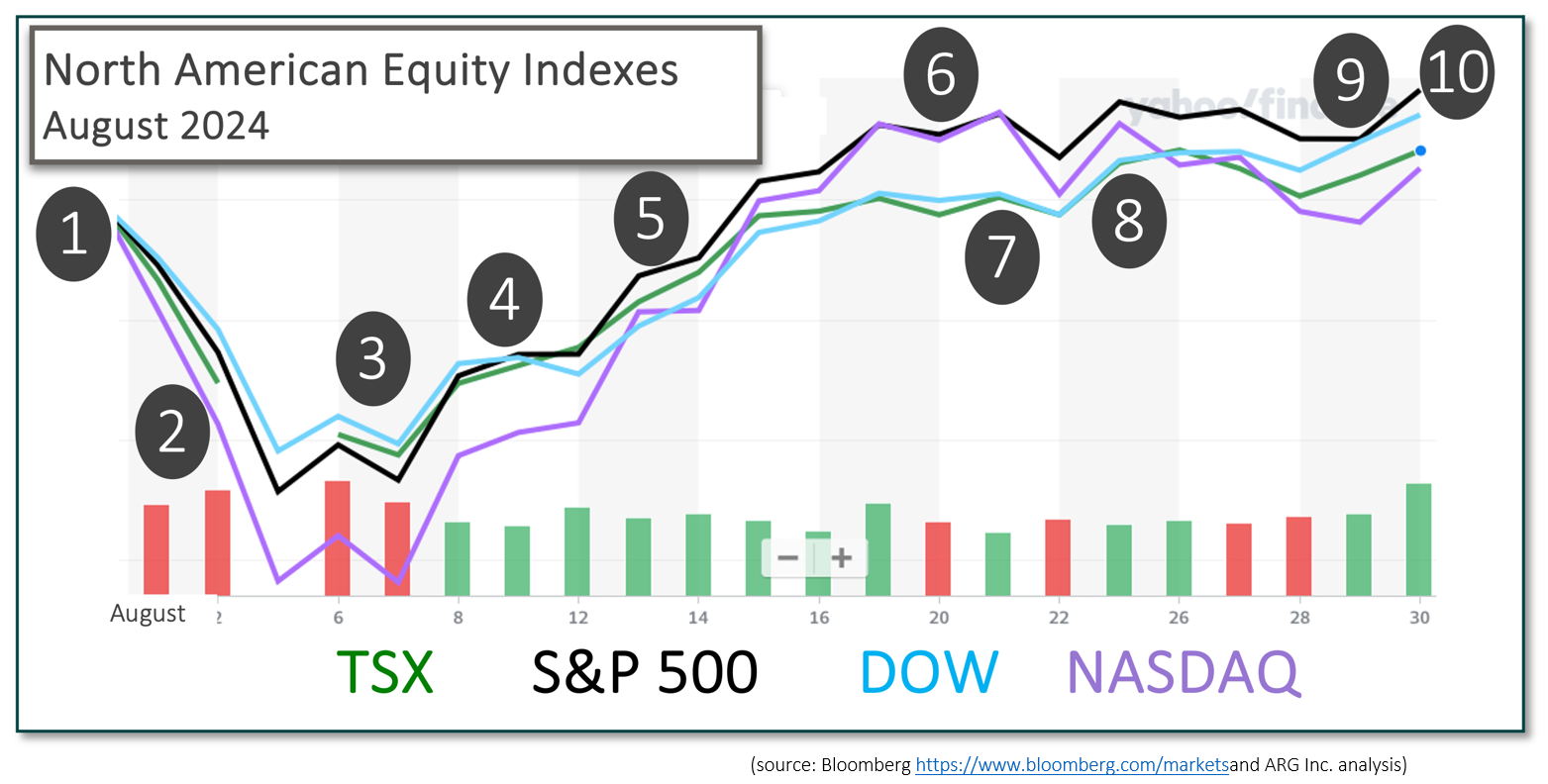

Last Month in the Markets: August 1st – 30th, 2024

What happened in August?

The month ended much better than it began. Equities were down for the first five trading days, and another eight days passed before regaining their starting levels of August 1st. Although the performance by the end of the month may seem sluggish, the rally during the last three weeks was impressive.

Inflation, employment and Gross Domestic Product were the most relevant subjects influencing markets, which has not changed since early days of the pandemic in 2020.

The notable events included:

July 31st

Just prior to the beginning of August, the Federal Reserve held interest rates unchanged. Jerome Powell, Federal Reserve Chair, said in his remarks at the press conference, “The softening in the labor market conditions give you more confidence that the economy’s not overheating.”

August 2nd

Job creation is slowing, and unemployment is rising according to the monthly report from the U.S. Bureau of Labor Statistics (BLS). Employment edged up by 114,000, which is about half the monthly average of 203,000 for 2024. CNBC and jobs

August 5th – 8th

Corporate earnings are not the issue according to FactSet's Earnings Insight for the S&P 500. With 91% of companies reporting, more than three-quarters of them have delivered a positive earnings surprise and more than half have delivered a positive revenue surprise. Also, the blended year-over-year earnings growth rate is 10.8%. If this level is maintained after all S&P 500 companies have reported, it will be the highest growth rate for earnings since 2021.

August 9th

On Friday, StatsCan released its latest Labour force Survey that reported employment was little changed in July (-2,800), and the unemployment rate was unchanged at 6.4%. Rising wages and stagnant employment over the past two months renders this report neutral for the Bank of Canada and its upcoming interest rate decision on September 4th according to economists. CBC and jobs

August 13th and 14th

The Producer Price Index (PPI) tracks wholesale inflation by measuring the change in prices paid to producers of goods and services. In July the prices of goods rose 0.6 percent and the index for services fell 0.2 percent. Producer prices have risen 2.2 percent on a year-over-year basis. PPI release

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 on a seasonally adjusted basis, after declining 0.1 percent in June. Over the last 12 months, the all-items index increased 2.9 percent before seasonal adjustment” according to the release from the Bureau of Labor Statistics. Nearly 90 percent of the monthly increase has been attributed to the index for shelter, which rose 0.4 percent in July. Energy prices were unchanged, and food prices matched the all-items increase of 0.2 percent. Core CPI, which excludes food and energy, has risen 3.2 percent on a year-over-year basis.

August 20th

Domestically, the Canadian Consumer Price Index (CPI) rose 2.5% on a year-over-year basis in July, increasing at the slowest pace since March 2021 and down from a 2.7% gain in June. The slowing rate of inflation is broad-based and lower prices for travel tours, passenger vehicles and electricity made a strong contribution. Grocery prices have risen 2.1% over the last year, which is below the overall rate of price increases.

On a year-over-year basis, the increase in shelter costs (+5.7% annually) slowed slightly but remains far above the all-items inflation rate. The mortgage interest cost index has risen 21.0%, down from June’s 22.3%. The annualized price increases on the rent index eased to 8.5% annually, compared to 8.8% last month.

In addition to the implications for daily and major purchases, inflation progress has been the primary consideration for the Bank of Canada and its interest rates. The next scheduled announcement is September 4th, and this week’s inflation data means that there is “nothing stopping the Bank from cutting rates by another 25 basis points” according to a TD senior economist. StatsCan CPI release CBC and CPI

August 21st

The Federal Reserve’s monetary policy committee released the minutes from its most recent meeting in July. Committee members confirmed a rate cut in September was likely if economic conditions, primarily employment and inflation, continue their downward trajectory.

In its annual review, the U.S. Labor Department revised the number of jobs created for the year ending March 31st by 818,000, which is 30% of the previously reported total. The second Federal Reserve’s mandate, in addition to “price stability” (i.e. inflation), is to maximize employment. As inflation has moderated and approached the Fed’s 2% goal, the importance of jobs data has risen. According to the Fed’s minutes of July 31st, the time to lower rates is approaching. CNBC and jobs

August 23rd

In his speech on Friday at the Fed’s symposium in Jackson Hole, WY, Chair, Jerome Powel, said, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

August 29th

The Payroll employment in Canada decreased by 47,300 in June, a decline of 0.3%. It was the first monthly decline in 2024. Since the beginning of the year, including June’s decline, employment has grown by 110,400. Job vacancies were little changed and stand at 554,000. StatsCan release

August 30th

“Real gross domestic product (GDP) increased 0.5% in the second quarter after rising 0.4% in the first quarter” according to StatsCan's release on Friday. The Canadian economy grew at an annualized rate of 2.1% in the second quarter as GDP per capita fell for the fifth consecutive quarter. The annualized growth rate was above the Bank of Canada’s estimate from July and above economist expectations, providing ample reason for the Bank of Canada to continue cutting interest rates. CBC and GDP

U.S. GDP grew at an 3.0% annualized rate in the second quarter. It was an upward revision from 2.8% reported last month, and more than double the 1.4% reported in the first quarter. Based on the improving economic activity, the likelihood of a Federal Reserve rate cut of ½ percent fell, as did the expectation for a recession. CNBC and GDP

U.S. inflation measured by core Personal Consumption Expenditures (PCE) price index increased 0.2% in July and 2.6% from a year ago. Core PCE excludes relatively more volatile food and energy. BEA PCE release CNBC and PCE

What’s ahead for September and beyond?

The Bank of Canada will release a monetary policy update and interest rate announcement midmorning on Wednesday, September 4th. The Federal Reserve’s announcement arrives 2 weeks later on the afternoon of September 18th. The attention and speculation around rate cuts will have significant influence over markets unless an unforeseen economic or political shock occurs.

Rates in Canada will directly affect borrowers, and U.S. rates have more significance for capital markets. At the beginning of September, the likelihood of a Federal Reserve rate cut was pegged at 100%, with 69% certainty it would be ¼ percent and 31% that it would be ½ percent, according to CME's FedWatch tool.