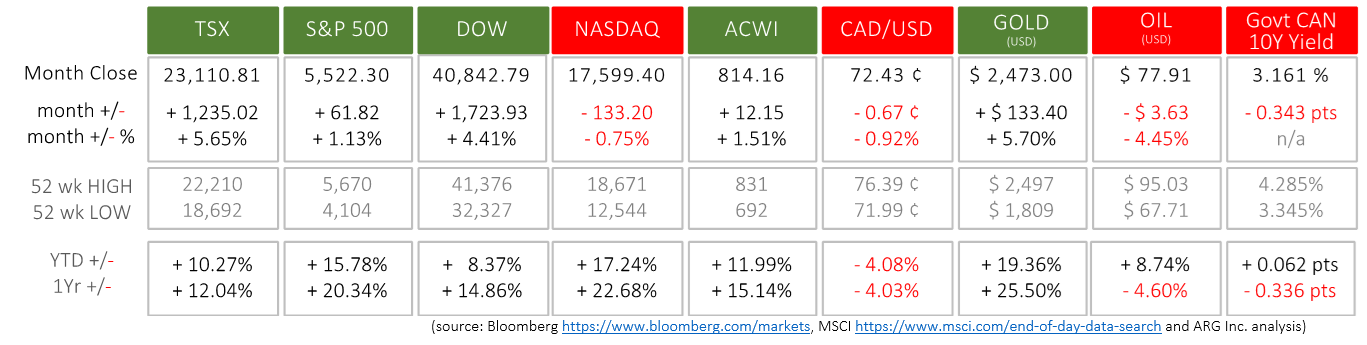

Last Month in the Markets: July 1st – 31st, 2024

What happened in July?

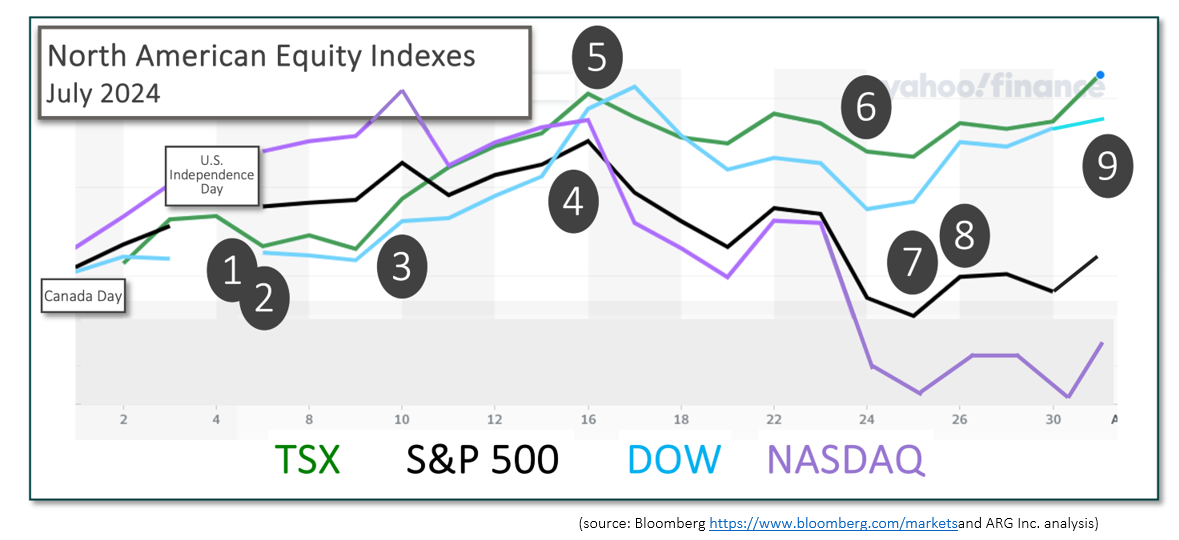

After Canada Day on July 1st and U.S. Independence Day on July 4th, economic events, news and data provided the impetus needed for equities and gold to rise. The exception for equity indexes was the NASDAQ that fell along with the Canadian dollar, oil and government bonds.

The notable events included:

July 5th

The Labour Force Survey from Statistics Canada reported, “Employment was virtually unchanged in June (-1,400; -0.0%). The unemployment rate increased 0.2 percentage points to 6.4% in June and has risen 1.3 percentage points since April 2023.” The slowing job market was predicted to be a catalyst for the Bank of Canada to reduce rates at their next announcement on July 24th. CBC and LFS

July 5th

In the U.S., “Total nonfarm payroll employment increased by 206,000 in June, and the unemployment rate changed little at 4.1 percent according to the Employment Situation Summary. Early reports suggest that the jobs report “could support the idea that [the Fed] will cut relatively soon” according to Goldman Sach’s chief economist. CNBC and nonfarm payrolls

July 10th

U.S. Consumer Price Index (CPI) declined by 0.1% in June, as gasoline prices fell and food prices rose, just as they did in May. Over the last 12 months consumer prices have risen 3.0%, down 0.3% from May’s 3.3%. This is the lowest level for the CPI in more than three years, and far below its peak of more than 9% experienced in June 2022. BLS CPI release CNBC and CPI

July 15th

A massive computer outage caused by a software upgrade by cyber security company, CrowdStrike, disrupted capital markets in addition to fouling transportation networks. The tech-heavy NASDAQ lost 3½ percent during the third week of the month after six weeks of gains.

July 16th

Canadian consumer price increases edged closer to the Bank of Canada’s 2% goal. “The Consumer Price Index rose 2.7% on a year-over-year basis in June, down from 2.9% in May”, according to the release from StatsCan. CIBC economist Katherine Judge said, “The inflation data for June gave the Bank of Canada what it needed in order to cut interest rates at next week’s meeting.” CBC and CPI

July 24th

The Bank of Canada lowered its overnight rate by ¼ percent (25 basis points) to a target of 4.5 percent, and released its latest Monetary Policy Report. According to the Bank of Canada announcement, “The Bank’s preferred measures of core inflation are expected to slow to about 2½% in the second half of 2024 and ease gradually through 2025.”

July 25th

StatsCan reported that payroll employment increased by 41,000 in May. It was the fifth consecutive monthly increase with 148,900 added jobs to-date in 2024. Nine of twenty sectors increased employment with health care, education, retail and transportation adding the most jobs.

July 26th

The U.S. Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, showed that prices have risen 2.5% on a year-over-year basis. Core PCE, which excludes more volatile food and energy, increased 2.6% since last year. Both are above the Fed’s 2% target for long-range inflation. PCE release CNBC and June PCE

July 31st

As expected, the U.S. Federal Reserve held rates unchanged in their FOMC statement. However, during the following press conference , Fed Chair, Jerome Powell, indicated that a rate cut in mid-September was “on the table”, providing a boost on the last afternoon of the month. CNBC and Fed

What’s ahead for August and beyond?

Inflation, and therefore interest rates will continue to heavily influence markets as central banks begin to adjust policy interest rates. The Bank of Canada has lowered its overnight rate by ¼ percent on both June 5th and July 24th and is the first G7 country to decrease rates. On July 18th, the European Central Bank held their rates steady. Just hours before the Fed’s announcement (above) to retain interest rates, the Bank of Japan increased its rates by ¼ percent. On August 1st, the Bank of England lowered rates for the first time in four years. Central bank actions have been inconsistent as inflation lowers at varying speeds.

The Bank of Canada and Federal Reserve will release interest rate updates on September 4th and 18th, respectively. After two recent rate cuts, the Bank of Canada Governor, Tiff Macklem, declared that the bank is “not on a predetermined path” for additional cuts. However, it is anticipated that the Federal Reserve will cut rates at its next meeting.