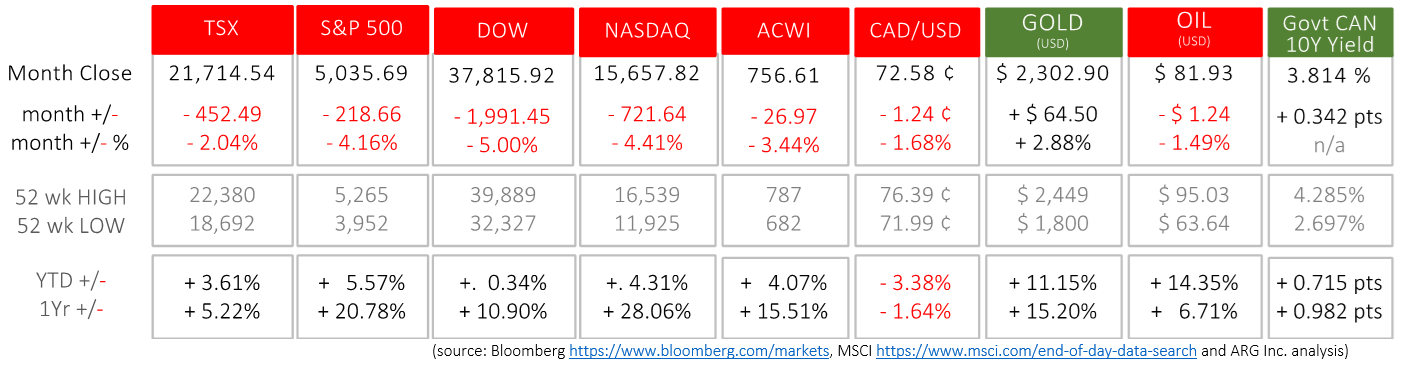

Last Month in the Markets: April 1st – 30th, 2024

What happened in April?

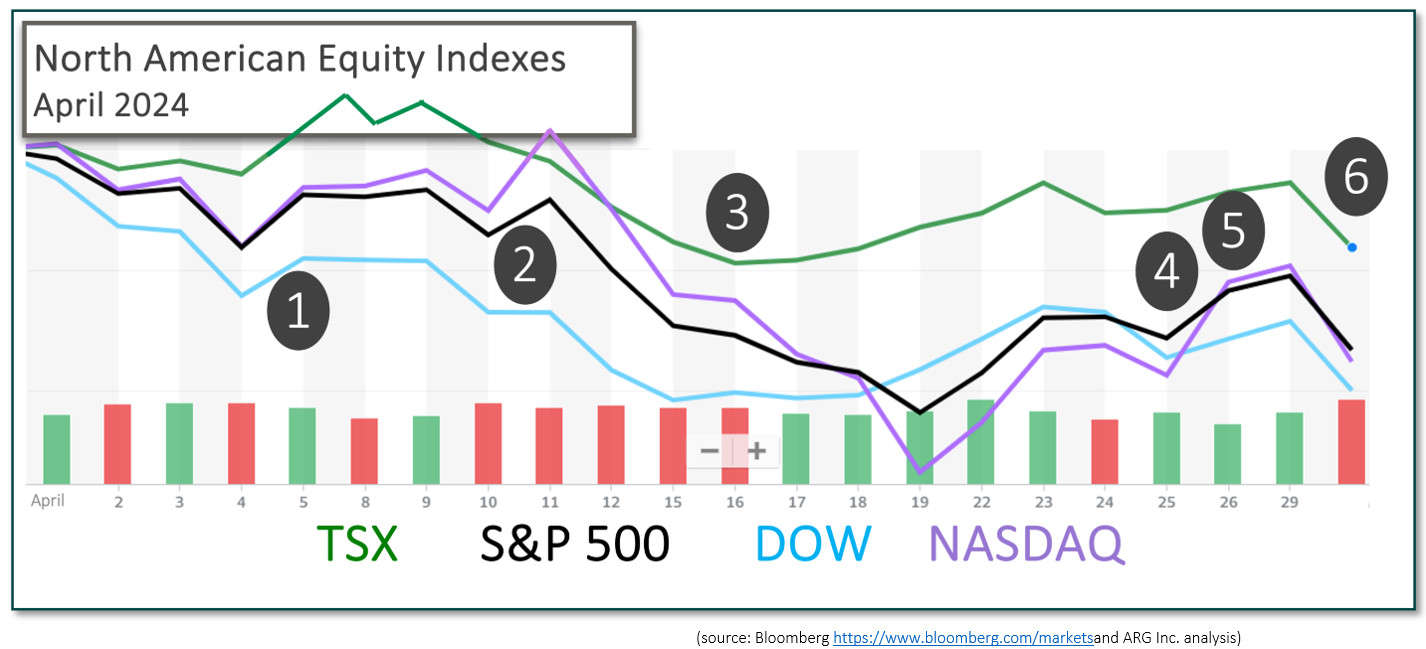

While delivering 2% negative returns, Canada’s TSX managed to fare slightly better last month than U.S. equity indexes. U.S. equity indexes returned the gains earned in March, and as well as some of February’s advances. The Canadian dollar also contributed to the poor performance relative to the U.S. with an additional loss of value of more than 1½%.

The economic announcements, including central bank actions, inflation, employment, and Gross Domestic Product, contributed to the 2 to 5 percent losses for equity indexes last month:

April 5th

Canadian and American job announcements demonstrated two differing economic directions. The strength or weakness of employment will contribute to upcoming interest rate announcements in each country, but the timing of cuts remains uncertain.

Canadian employment fell by 2,000 jobs in March and the unemployment rate rose 0.3% to 6.1%. Since last year the Canadian unemployment rate has risen 1 percent as the number of unsuccessful job seekers has grown by approximately 60,000 over the past twelve months. StatsCan Labour Force Survey

In the U.S. total nonfarm payroll employment rose by 303,000 in March. It was the 39th consecutive month of rising employment. The unemployment rate sits at 3.8% and changed little since last month as 6.4 million workers attempt to find jobs. BLS Nonfarm Payroll Report

April 10th

The Bank of Canada held its policy interest rates unchanged. The announcement stated, “While inflation is still too high and risks remain, CPI and core inflation, have eased further in recent months. The council will be looking for evidence that this downward momentum is sustained.” February’s Canadian CPI has fallen to 2.8% and the Bank “expects CPI inflation to be close to 3% during the first half of this year, move below 2 ½% in the second half, and reach the 2% inflation target in 2025.” Canada is ahead of the U.S. in lowering domestic inflation, cooling the economy and employment, and “economists have forecast that the Bank of Canada will lead the U.S. Federal Reserve in rate cuts as economic data in both countries have been diverging.” BoC CBC

U.S. CPI increased 0.4% in March, the same increase that was reported one month ago for February. Over the past 12 months, the all-items index increased 3.5% in March, higher than the 3.2% record for February. Gasoline and shelter contributed over half of the monthly increase. The food index rose 0.1% in March, food at home was unchanged as food away from home rose 0.3%. Core CPI, all-items less food and energy, also rose 0.4% in March. BLS CPI release

April 16th

The new federal budget also proposes a change to the tax treatment of capital gains, which may facilitate portfolio adjustments for a small number of investors. Capital gains inside registered accounts (like TFSAs and RRSPs) and principal residences will not be affected. Outside of these accounts, gains below $250,000 will follow the current 50% inclusion rule, and above $250,000 two-thirds of the gain will be subject to taxation. 2024 Budget Chapter 8 CBC and Cap Gains

Federal Reserve Chair, Jerome Powell, echoed comments of his fellow Fed officials that rates will remain higher for longer. Referring to the response of inflation to higher rates, “We’ve said at the [Federal Open Market Committee] that we’ll need greater confidence that inflation is moving sustainably towards 2% before [it will be] appropriate to ease policy. The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.” CNBC and rates

Canadian Consumer Price Index (CPI) for March rose 0.1% from February and sits at 2.9% on a year-over-year basis. U.S. CPI for March came in higher last week at 3.5%. The rise in prices for shelter (rent and mortgage costs) and services was higher than goods, and in aggregate prices rose 0.6% in March. StatsCan CPI

April 25th

The latest real Gross Domestic Product (GDP) data from the Bureau of Economic Analysis (BEA) showed that annualized economic growth has slowed to 1.6% in Q1 2024, down from 3.4% and 4.9% in Q4 and Q3 of 2023, respectively. Slowing GDP growth relieves pressure to maintain current interest rates if it leads to lower inflation levels and job creation. BEA release CNBC and GDP

April 26th

The Federal Reserve’s preferred inflation indicator, the Personal Consumption Expenditures (PCE) price index fulfilled predictions. Jerome Powell, Fed Chair, stated that U.S. consumer inflation is reluctant to return to pre-pandemic levels despite the elevated levels of interest rates. Inflation arose due to a shortage of supply, which drove prices higher. As supply chain issues resolved and inflation persisted, central banks increased interest rates designed to curtail demand, and inflation, back to low and predictable levels. For March, U.S. PCE was 2.7% year-over-year, compared with January and February’s 2.5%. All three months are above the Fed’s goal of an average of 2%, and the last month is increasing. BEA PCE release CNBC and PCE

Canada is ahead of the U.S. in its inflation fight evidenced by slowing economic and job growth. Although the U.S. sets the tone for interest rates globally, Canada can change interest rates ahead of the Americans. Markets will react if the Bank of Canada is too far ahead of the Federal Reserve, either in timing or size of interest rate reductions. Recent economic news, especially March’s PCE reading, is pushing the likelihood of lower Federal Reserve interest rates further into the future, which wills likely delay a rate cut here. CNBC and PCE

April 30th into May 1st

April transitioned into May with a Federal Reserve interest rate announcement. Markets awaited confirmation that the Federal Reserve would keep interest rates unchanged, and the Fed did not disappoint analysts. The federal funds rate will stay in the range of 5¼ to 5½ percent. The Fed will reduce its holdings by $35 Billion per month, which reduces liquidity in the system. Fed release

What’s ahead for May and beyond?

As recently as December/January markets had predicted three interest rate cuts in 2024 for the Federal Reserve, based on the comments from Jerome Powell, Fed Chair; the timing of the first rate cut this year is uncertain. Inflation has not responded as the U.S. economy continues to create jobs that drive demand and bolster inflation’s higher than desired levels.

Prior to the announcement on May 1st, the probability of lower rates did not exceed 50% until November 7th, which is after the U.S. elections. Immediately after the Fed rate announcement and press conference, equities moved upward, and the timing of rate cuts did not materially change. CME FedWatch tool