What happened in January?

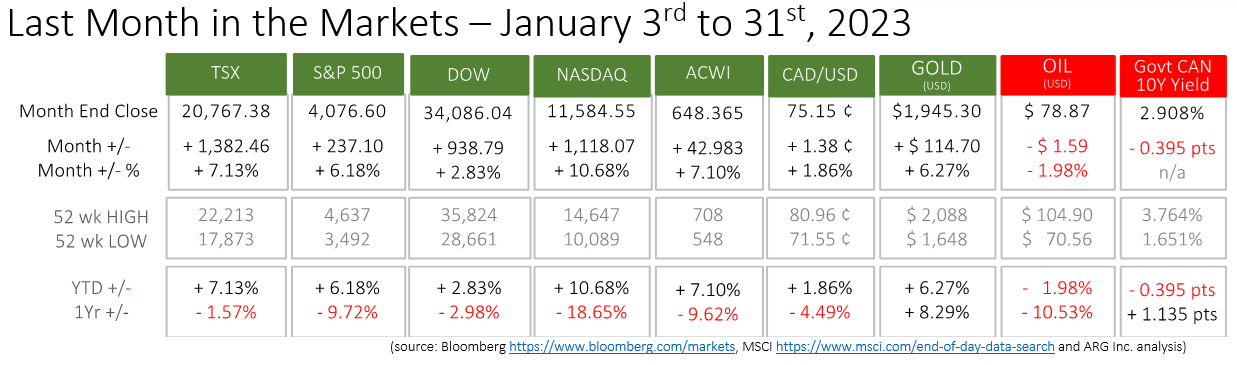

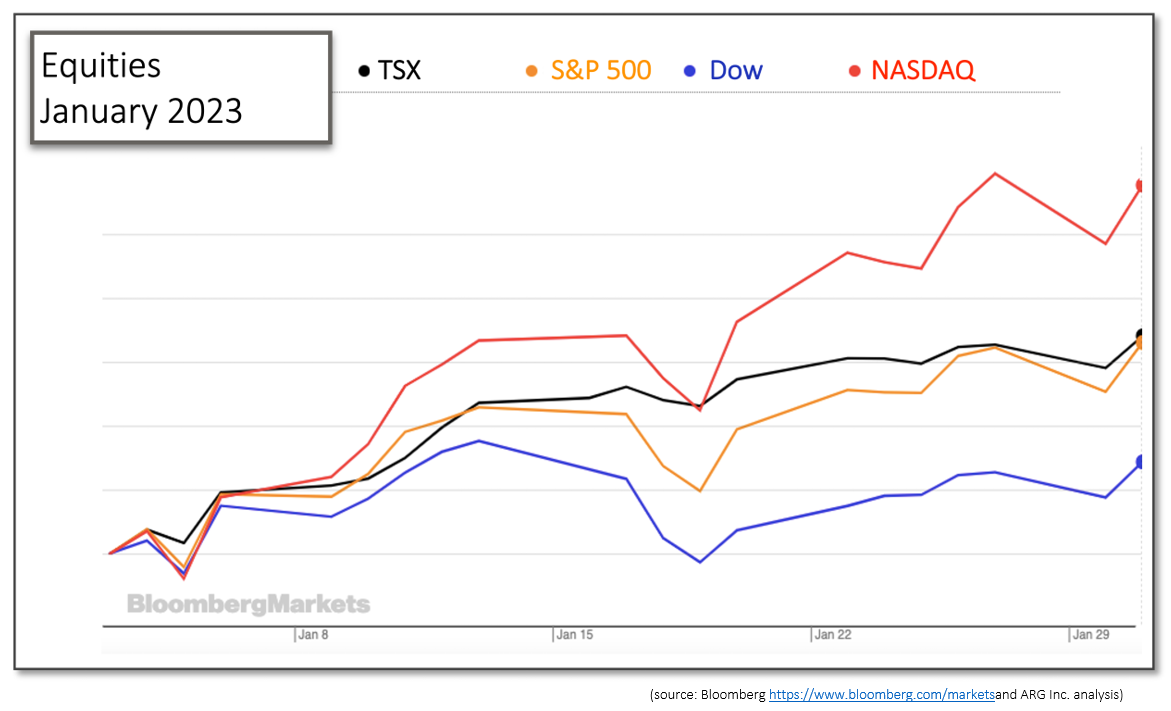

Last month proved to be a much more tensionless month than most for investors of almost every type. The major equities indexes, where most hold the majority of the assets to fund future retirement, all gained dramatically. The Dow, which only advanced by 2¾% over the course of January was the laggard. The relatively broad-based TSX and S&P 500 moved ahead seven and six percent, respectively, and the tech-heavy NASDAQ jumped over 10%.

Reducing the anxiety for investors was the consistent and repeated daily increases. Only a few days during January failed to deliver positive gains, and each of those were associated with legislative and economic events emanating from the United States:

January began with the U.S. House of Representatives unable to elect a Republican Speaker of the House. The negotiations and debate continued for several days and were more prolonged than any Speaker’s election in more than a century and a half. Eventually, Kevin McCarthy prevailed, and then the speculation that he had ceded too much power to achieve the position began in earnest.

Debate regarding the Republican’s ability to move the economy forward by cutting taxes also commenced as McCarthy’s tenuous leadership began.

Just after mid-month, equities faltered as the U.S. debt ceiling reached its limit. The Department of the Treasury began utilizing extraordinary measures to keep the federal government operating. These included suspending new investment in retirement and healthcare funding for the Civil Service Retirement and Disability Fund and the U.S. Postal Service Retiree Health Benefits Fund, sales of State and Local government treasury securities, and reinvestments in the Exchange Stabilization Fund.

Collectively, the Treasury’s actions provide about five months for the somewhat divided Republicans, who, technically, control the house, and the unified Democrats who stand in opposition.

The penultimate day of January was negatively affected by the upcoming Federal Reserve interest rate announcement on Wednesday, February 1st. In comments during and since the last monetary policy release, the Fed has steadfastly maintained its commitment to controlling demand-driven inflation. The markets have wavered between accepting economic “good news” for Gross Domestic Product and jobs at face-value and interpreting “good news” as fuel to inflation, which will increase the Fed’s resolve.

Rates are widely expected to increase, and the accompanying commentary will be heavily parsed to understand intentions for additional rate rises. CNBC and rates

The distractions of Speaker elections, legislative control and debt ceiling attainment did little to disruption a very positive month to begin the year for equity investors.

What’s ahead for February and beyond in 2023?

The continued reliance on monetary policy as a bellwether for markets and investors monitoring their portfolios is fatiguing. Unfortunately, this situation will continue until inflation is under control and approaching the target inflation rate of 2%. The Bank of Canada and the Federal Reserve expect inflation to fall enough to stabilize and ease rates in 2023 and early 2024.

The policy interest rates in Canada and the U.S. are expected to settle in the range between 4½ and 5½% to achieve the restrictive economic conditions necessary to arrest price increases.

The Federal Reserve took another step toward controlling inflation on February 1st by raising the federal funds rate by 25 basis points to a range of 4.5% to 4.75%.

Once achieved, rates will be lowered to the estimated neutral rate of interest, where full employment has been achieved and inflation is constant. This represents a situation where interest rates are neither restrictive nor expansionary, and have been estimated at about 2.5% for both Canada and the U.S.

Federal Reserve Bank of Canada Brookings Institute WaPo and Neutral Rates