What Happened in October?

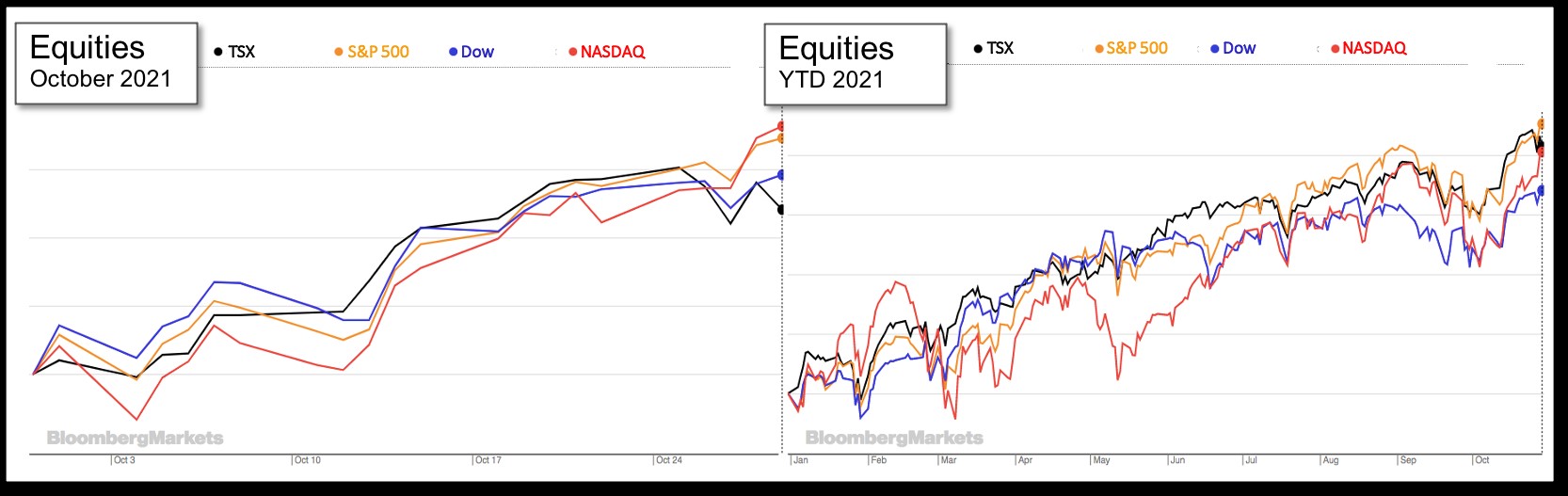

October was kind to most investors. Equity indices rose steadily, with most indices seeing gains ranging from 5% to 7%. The typical mid-month “dip and recover” was replaced with a brief pause for the U.S. indexes and a flat spot for the Canadian index (below). This was concentrated around October 10th.

While the final days of trading saw American equities as the top performers, the TSX held its own and was not far behind the three big players in the US.

The Canadian dollar, gold, oil, and North American equities all performed well despite economic news that was not entirely positive:

- One positive report that came in October was the Canadian Job Report. 157,000 Canadian jobs were added during September. This increase in beat analyst expectations. The unemployment rate fell to 6.9%, the lowest level since the pandemic began in 2020. Companies continue to face labor shortages as they struggle with the fallout of almost 400,000 Canadians not rejoining the workforce.

- The U.S. added only 194,000 jobs in September. This is the lowest monthly increase in 2021 and well below analyst expectations. Unemployment is down to 4.8%, but the lower rate was mainly driven by a lack of jobseekers. As a result, American workers have seen an increase to their wages of nearly 5% since last year. This can be attributed to the inability of labor supply to keep up with production demand.

- The International Monetary Fund (IMF) released its World Economic Outlook this month. The headline read “Global Recovery Continues, but the Momentum has Weakened, and Uncertainty has Increased”. The slowdown has been attributed in part to supply disruptions in advanced economies and worsening pandemic conditions in developing countries.

- The U.S. consumer inflation rate rose 5.4% in September. The Federal Reserve has maintained its stance that the high rate of inflation is temporary. Despite the Federal Reserve’s attempt at reassurance, concern is growing that inflation may not be as transitory as hoped, based on recent data from the housing market.

- Expectations to taper Federal Reserve bond purchases, which would increase the cost of long-term borrowing, is continuing to grow. This move is predominately being driven by increasing inflation but could also see delays with stalling GDP and lagging employment numbers. Based on the Fed’s prior statements, an increase to the benchmark interest rate is not expected until 2022 or 2023.

- Canada’s inflation rate for September was 4.4%. The assumption that current inflation is temporary and related directly to the reopening and recovery of economies is beginning to be questioned by some. When food, shelter and transportation prices rise (3.9%, 4.8% and 9.1% respectively), concern follows that price increases are not transitory. Eventually, inflation will pressure central banks to slow price increases by slowing economic growth.

- The effects of the Covid-19 delta variant have not been as dire as originally predicted. In most developed economies, aside from a few dangerous pockets of infection, high cases-counts and severe illness have been avoided or have been and seeing a downturn.

- Significant news from the Bank of Canada this month was that their quantitative easing program of bond-buying would be ending due to inflation pressures and job growth. Secondarily, the Bank’s forward guidance has an interest rate increase predicted for the middle of 2022, rather than at the end of next year.

- The Bank of Canada, much like the U.S. Federal Reserve, has inflation control and employment maximization at the top of their to-do list. Bond-buying lowers the long-term borrowing rate for businesses and household. This in turn encourages and allows major investments that contribute to economic recovery. Further reducing the quantitative easing program back to zero reduces overall demand and upward price pressures (inflation). This move will likely slow economic growth and unfortunately, the job market could be a causality.

What is Ahead for November and Beyond?

The Bank of Canada has taken action to reduce economic supports and it may be time for the U.S. Federal Reserve to follow suit. The next U.S. monetary policy announcement occurs November 3, 2021, following the Federal Open Market Committee meeting. The results of this announcement provided by Jerome Powell, Federal Reserve Chair, could give guidance to investors on what moves they should make in the short-term.

Powell’s actions will be covered by the media in the U.S. and Canada. The official announcement can be found after 2:00 pm EST on November 3rd, at https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm.