Last Month in the Markets – June 1st – 30th, 2021

What happened in June?

In many ways the last month of the first half of 2021 was typical:

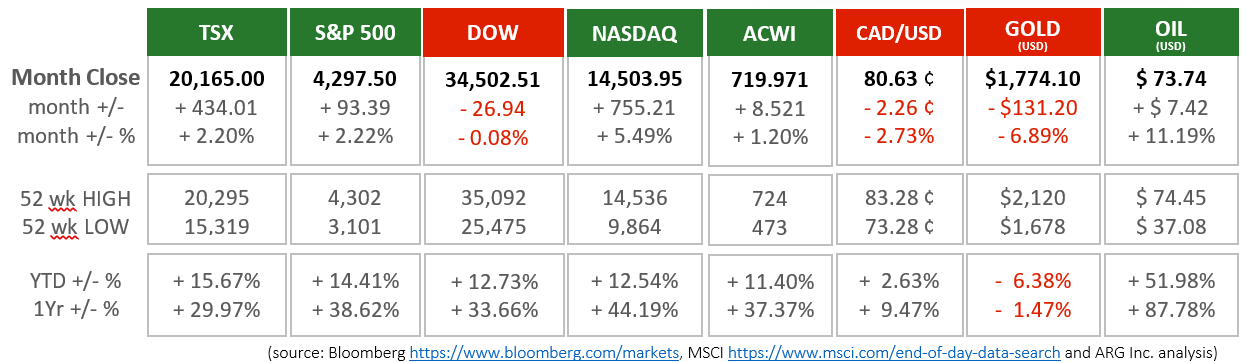

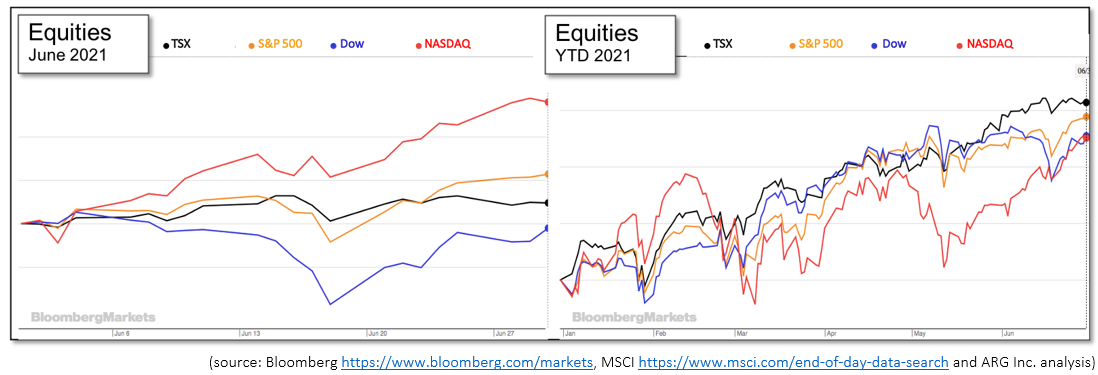

The TSX, where the most Canadians’ equity holdings reside, is the leader in year-to-date performance besting the major American indices by as much as 3% for the first six months of the year. This performance occurred despite the 68,000 job losses in Canada for May that pushed the unemployment rate to 8.2%. The U.S. added 559,000 jobs in May, which was below the consensus expectation of 670,000 jobs. In both countries the staging and scale of reopening weighed heavily on employment and jobs numbers. As Canada reopens jobs are expected to be added in large numbers during the second half of the year. In the U.S. May’s new job creation was double the number of April as they continue deeper into their recovery.

As of the end of May Canada has 700,000 fewer jobs than pre-pandemic levels while the U.S. has nearly 8 million less jobs. There is significant opportunity to add jobs as each economy recovers. The level of unemployment will likely result in new jobs, not higher wages, as expansion occurs. This should lessen and/or delay inflation, which could spur central bank action of interest rates increases.

Much of the turmoil during the third week of the month when equity indices lost as much as 3½% was attributed to the U.S. Federal Reserve’s statements on Wednesday, June 16th. Although interest rates remained stagnant, the spectre of inflation was prominently featured in the announcement by Jerome Powell, Fed Chair, and will influence the timing of future interest rate increases. The Fed has two primary mandates, control inflation and maximize employment. The Fed is watching inflation closely and could cause a reversal or slowing of employment gains to stifle inflation.

The latest announcement from Powell and the Federal Open Market Committee (FOMC) states, “The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.” Since inflation has been below 2%, it will be allowed to float above 2% for some time to arrive back at the 2% average for the longer term. Federal Reserve expects to increase interest rates in 2023, and perhaps twice. https://www.federalreserve.gov/newsevents/pressreleases/monetary20210616a.htm

The Bank of Canada held its monetary policy steady with bond purchases and interest rates unchanged in their announcement on the prior Wednesday. Inflation is at the upper end of the bank’s preferred range, but the temporary nature of the recovery has slowed any monetary policy changes. This could be a foreshadowing of upcoming Federal Reserve (in)action. https://www.bankofcanada.ca/2021/06/fad-press-release-2021-06-09/

Inflation and monetary policy responses will heavily influence equities over the next few weeks and months. Canadian inflation for May was 3.6%, a slight increase from April’s 3.4%. The Bank of Canada has had a similar stance as the Federal Reserve regarding inflation. Inflation will eventually cause interest rate increases if it exceeds targets. However, both the Canadian and American central banks are similarly cautious and take action after deliberation. The recovery is not complete and measures, like an interest rate increase, that are intended to reduce inflation by slowing the economic rebound will not be viewed favourably by most but will be necessary at some point in time.

In Canada, the latest jobs figures are more optimistic than one month ago. After losing 207,000 jobs in April the loss of 68,000 jobs was less severe. The unemployment rate rose in May to 8.2% from April’s 8.1%. Labour force participation is a little troubling as youth and women are no longer seeking employment due to the adverse business conditions. In the U.S. nearly 600,000 jobs were added in May as reopening is occurring more quickly than Canada and many other countries.

The jobs and Gross Domestic Product rebounds in the U.S. should foreshadow the long-term expansion in Canada and globally as the pandemic ends and the virus is controlled.

What’s ahead for July and beyond?

Case counts driven by vaccination levels will continue to heavily influence markets. The surest way to reach full recovery is to prevent the need for social and economic measures to control the virus.

As of July 1st, 68% of Canadians have received at least one dose and 31% are fully vaccinated placing us in 3rd and 32nd place, respectively, among countries. In the U.S., 54% of Americans have received one dose or more and 47% are fully vaccinated (26th and 13th place, respectively). https://www.nytimes.com/interactive/2021/world/covid-vaccinations-tracker.html