What happened in March?

The markets have reacted directly to local and global success against the pandemic continued, as expected, throughout the month of March. As vaccinations were finally building some momentum, restrictions began to be relaxed and the unfortunate response has been a rise in Covid-19 cases across Canada, the United States and many other countries. This pattern of rising infection rates after lowering restrictions will continue as long as herd immunity has not been achieved as economies are reopened. Our ability to contain the spread of the virus will depend on the number, variety and infectiousness of virus variants as well as protective measures and vaccinations

For retail investors the volatility, that was witnessed in March, is expected to persist for the rest of the spring, the summer and into the autumn of 2021.

However, the news in March was not all negative, several bright spots emerged:

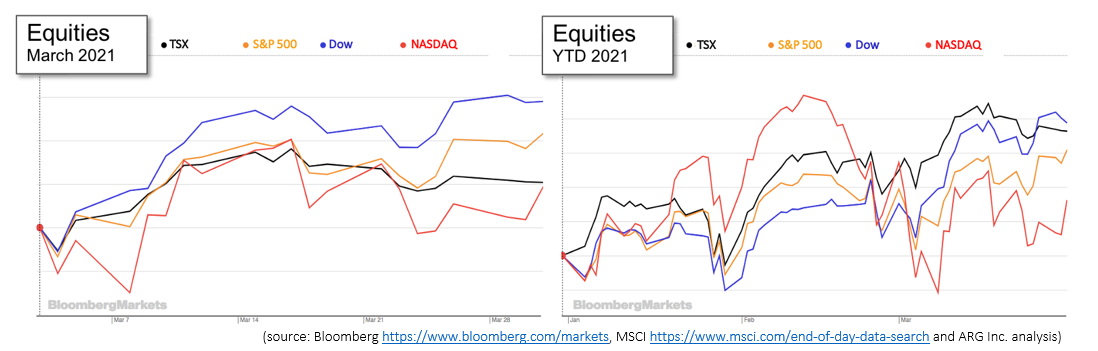

- Each of the major North American indices and the All-Country World Index (ACWI), above, have made strong gains to date in 2021 ranging from almost 3% to nearly 8% during the first quarter.

- Despite a 3% loss this month the price of oil has risen 23% in 2021 and almost 200% from one year ago.

- The U.S. Covid-relief bill passed through Congress and was signed into law. The $1.9 Trillion bill contains multiple measures to provide rent relief for individuals and businesses, support for households with direct payments to individuals and specific initiatives to assist lower income individuals.

- Later in the month, stimulus cheques began to arrive for American families and are expected to increase consumer spending in the short term.

- For longer term economic recovery, a proposed infrastructure bill has been introduced by the Biden administration. Both measures are designed to spur economic recovery.

- Indicators show that growth in the inflation rate has slowed or are lower than previously predicted. Consequently, central banks are not expected to take any action that would slow economic growth in an attempt to tamp down inflation. The Bank of Canada held its interest rate and bond-buying program steady in its announcement on March 10th.

- The U.S. Federal Reserve also continued its communication that interest rate increases are not expected until 2024, which provided price support for equity values.

- In Canada the Federal and Provincial government fiscal measures and Bank of Canada monetary policy moves have been generally successful. Fortunately for families and the most vulnerable, foreclosures and evictions have not risen as quickly as employment and business closures, but it has been very difficult for many.

- Governments and the central bank were forced to conduct operations virtually while designing and implementing solutions in record time. A recap of some of the activity can be found here, it serves as a reminder of the challenges we have faced and solutions and revisions that have been enacted. Bank of Canada article

- The Organization for Economic Cooperation and Development (OECD) has increased its forecast for global GDP growth for this year.

Despite all of the dire predictions and upheaval to families and individuals, including the loss of life in Canada and around the world, the markets which reflect economic health have performed well. Record highs have been reached recently by the Dow, S&P 500 and the TSX, after the NASDAQ had been setting records.

What’s ahead for April and beyond?

Expect many measures to slow or contain the spread of the coronavirus to be announced in the next few days. Just as March ended and April began, Quebec City and Gatineau are on lockdown, school closing schools have been warned for the days immediately following Easter and Passover (and would lead into the rescheduled “March Break” in Ontario).

Markets will be watching the Covid-19 cases, hospitalizations, ICU occupancy and deaths closely. There will be more economic stress ahead as a third wave moves through major economies.

Should you have any questions regarding the effect of the pandemic on your investments, do not hesitate to contact our office.